VALUATION METHODS

We discuss the decision-tree and binomial-lattice methods that we used to value Agouron.

Decision-Tree Method

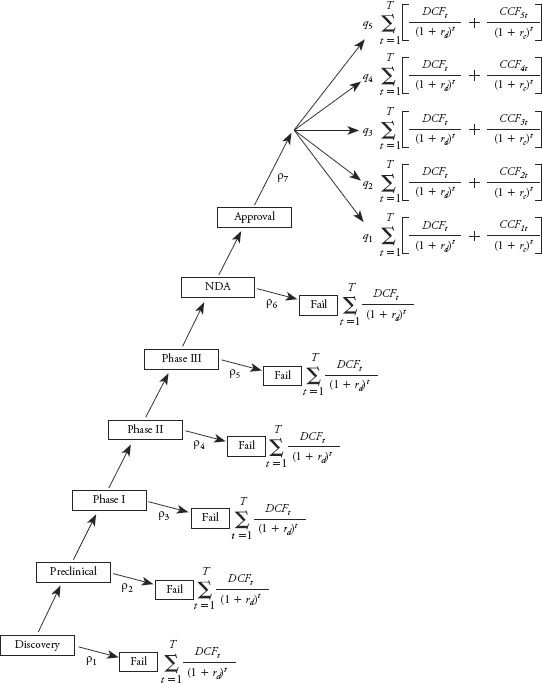

In the first method, we constructed a model with the purpose of calculating the expected net present value (ENPV) of a drug without taking into account growth options. The ENPV was calculated as

where

i = 1,. . ., 7 = an index of the seven stages from discovery through postapproval described previously

ρi, = conditional probability that stage i is the end stage for a drug that has reached stage i − 1

T = time at which all future cash flows become zero

DCFi,t = expected development stage cash flow at time t given that stage i is the end stage

rd = discount rate for development cash flows

j = 1,. . ., 5 = an index of quality for the drug (defined previously)

qj = probability that the drug is of quality j

CCFj,t = expected commercialization cash flow at time t for a drug of quality j

rc = the discount rate for commercialization cash flows

This decision-tree model is represented graphically in Figure 23.2.

FIGURE 23.2 Decision Tree for Pharmaceutical Development

The use of different discount rates for development cash flows and commercialization cash flows follows Myers and Howe, who based their selection of rates partly on Myers and Shyam-Sunder (1996). ...

Get Valuation Techniques: Discounted Cash Flow, Earnings Quality, Measures of Value Added, and Real Options now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.