BOOK VALUE VS. ECONOMIC VALUE WEIGHTS

The potential for introducing errors into dividend valuation analysis can materialize not only from ignoring the affordable dividend concept, but also from using book value rather than economic value weights in assessing target capital structure. The use of book values leads to improper weights and therefore to errors in valuation.5 This can be shown using the previous illustration.

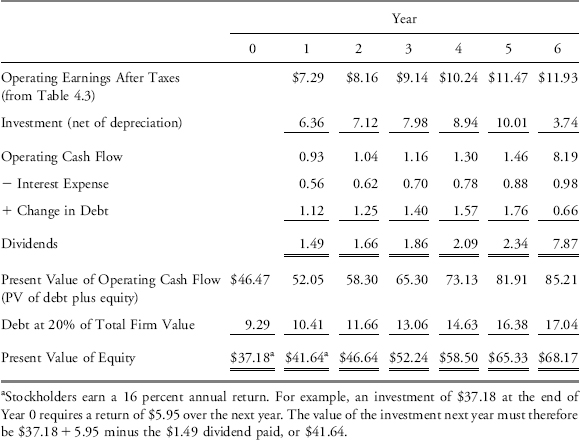

Table 4.8 gives affordable dividends and equity values for each year up to Year 6. The equity value at Year 0, using value weights rather than book weights for capital structure, is calculated with the use of the cash flow model given in Table 4.9 and the dividend discount model given in Table 4.10 In each case, the equity value at Year 0 is $37.18 million. The cash flow and dividend models will yield identical values only if capital structure weights for debt and equity are based on economic value rather than book value. Note that this is precisely what is done in Table 4.8 where in each period the debt-to-equity ratio is maintained at 25 percent or, alternatively, the capital structure consists of 20 percent debt and 80 percent equity.

TABLE 4.8 Affordable Dividends and Equity Values, Economic Value Leverage Approach (millions of dollars)

TABLE 4.9 Value of Equity at Year 0, Economic Value Leverage Approach Using the Cash Flow Model (millions of dollars)

Get Valuation Techniques: Discounted Cash Flow, Earnings Quality, Measures of Value Added, and Real Options now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.