Rehabilitation Project

The initial hypothetical example in this chapter deals with a ground-up construction project. This portion of the text discusses an existing project that requires work to enhance its value. This work can be as simple as a cosmetic facelift, for example, paint, landscaping, and/or paving, or as extensive as a major makeover, for example, a new façade and new structural support columns. The subtitle to the chapter, “Build to a 12 Percent Yield” applies to any project, including a rehabilitation project, wherein value is to be created.

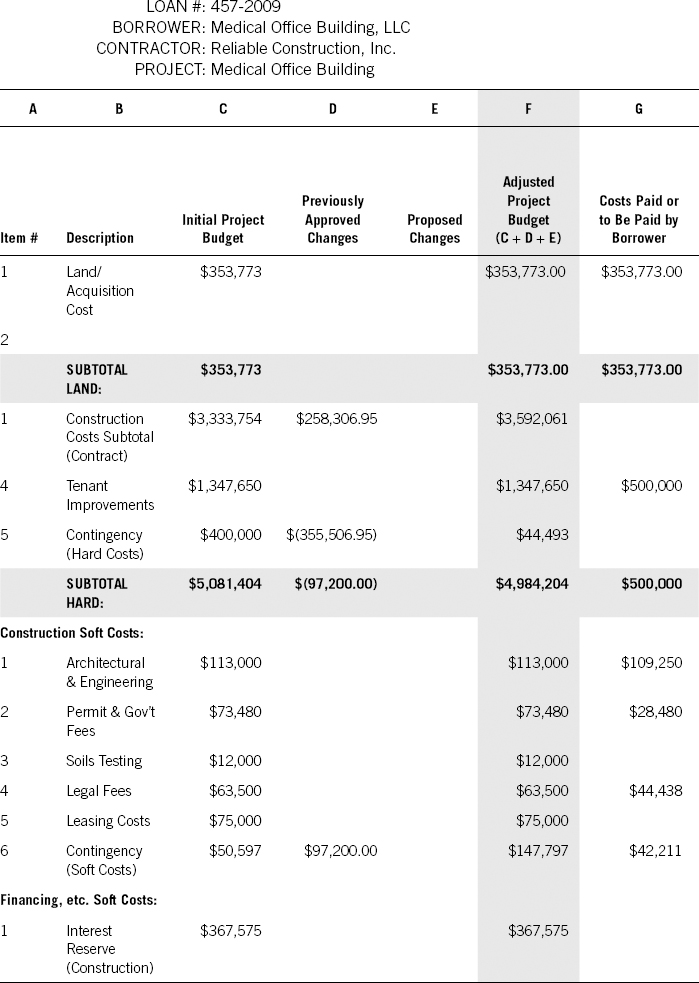

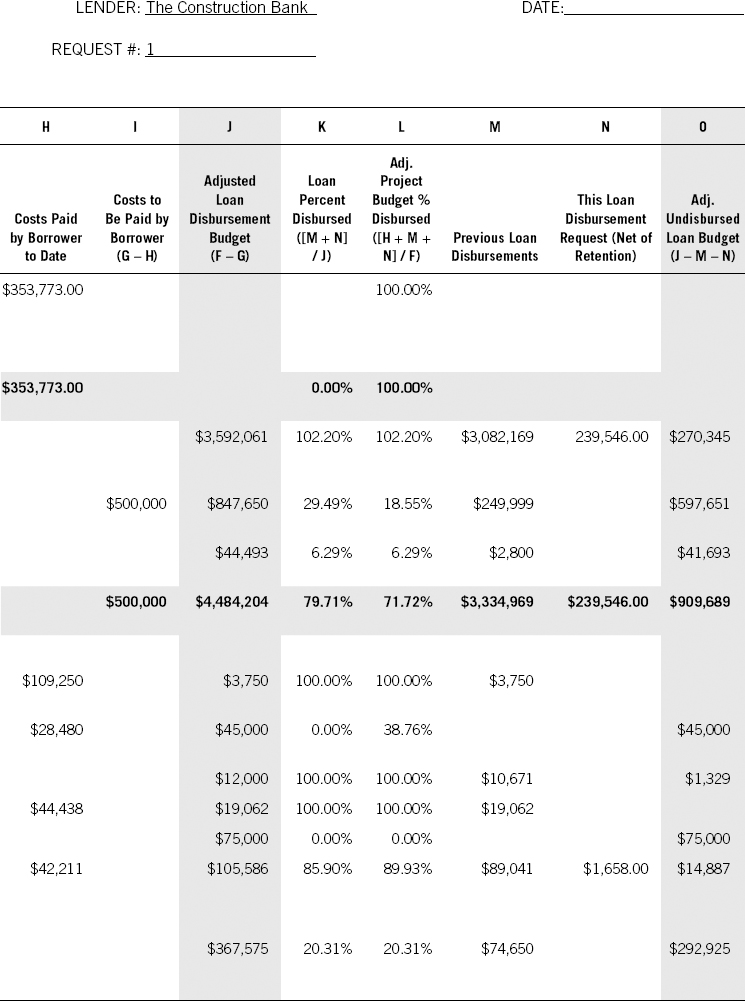

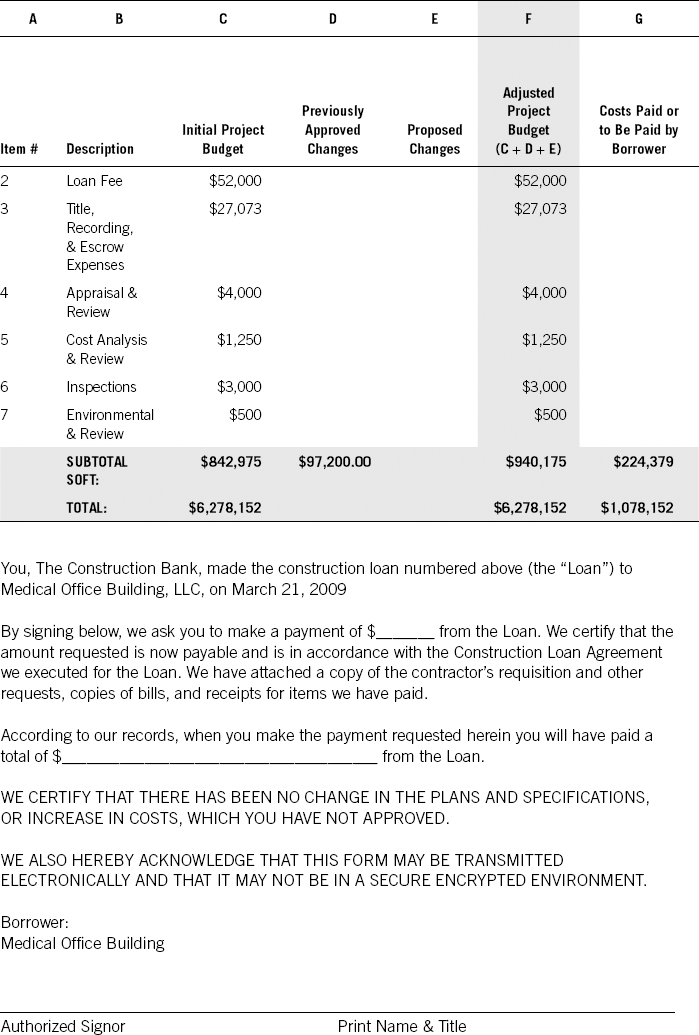

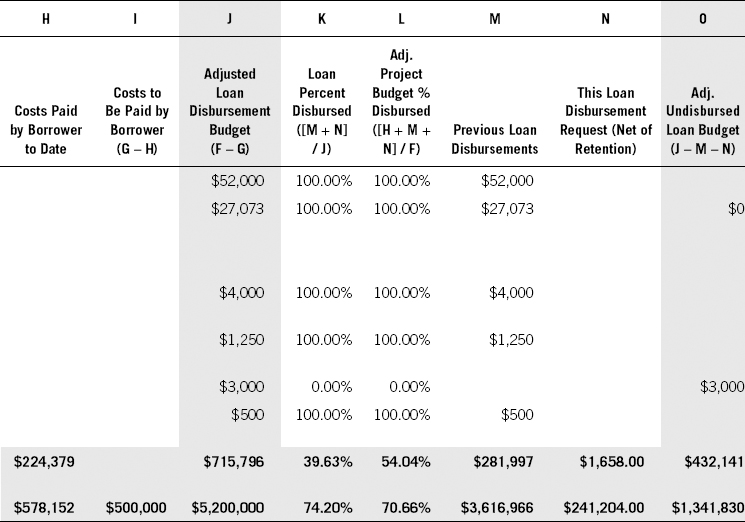

Exhibit 9.3 Lender's Disbursement FormLENDER'S DISBURSEMENT BUDGET & APPLICATION FOR PAYMENT

Let us assume that we are considering purchasing a 90,000 square foot shopping center, called The Metro Plaza. The existing rent roll is shown in Exhibit A.7 on the companion website. In the broker's sale package, the income and expense analysis suggests a current NOI of $800,000. (See Exhibit 9.4.)

Exhibit 9.4 Metro Plaza Income and Expense Analysis

How do we decide what to offer for this property? We may find an answer to this question ...

Get Wealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment Properties now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.