3. Value Point

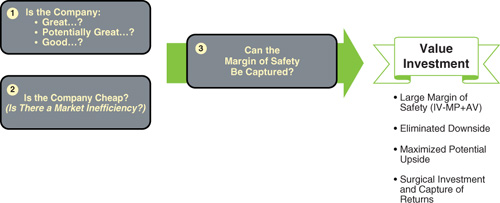

I summarized value point as asking three questions and getting four answers, as shown in Figure 3.1. On the surface, this is very similar to traditional value investing (such as buying a good company cheap). However, significant extra detail is included within the treatment of the margin of safety (Question 3 in the figure) to deal with all the mentioned problems when “going global.” The previous chapter’s focus on the mechanics of Graham’s Method and on building uncertainty analysis into the language of value investing was in order to address the added complexities of Question 3.

Figure 3.1. Value point

For all effective purposes, ...

Get What Would Ben Graham Do Now?: A New Value Investing Playbook for a Global Age now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.