Book IV

Preparing Income Statements and Balance Sheets

In this book…

- Understand accounting standards that govern financial reporting for businesses and nonprofit organizations. To ensure accuracy and transparency, you need to know and comply with these standards.

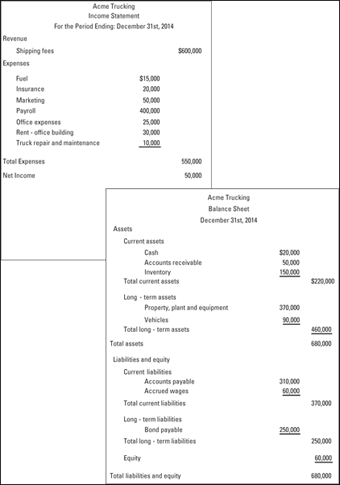

- Prepare an income statement to disclose a company's bottom line — its net profit or loss. Business owners, executives, and managers, along with investors, often head first to the bottom line to assess an organization's financial condition.

- Report the value of a company's current assets on the balance sheet. Assets are everything the business uses to generate a profit. See how a business converts current assets into cash and puts it to use within the course of a year.

- Disclose debt in the balance sheet's liabilities section and distinguish short-term from long-term debt. (Hint: Short-term debt must be repaid in less than a year. Long-term debt is repaid over the course of a year or longer.)

- Calculate the dollar amount of equity in a company and report it in the equity section of the balance sheet. Discover a business's equity — what it would be ...

Get Accounting All-in-One For Dummies now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

You can use income statements and balance sheets to prove your business's creditworthiness to prospective lenders. Find out how by visiting

You can use income statements and balance sheets to prove your business's creditworthiness to prospective lenders. Find out how by visiting