The settlement amount of £200 due to the clearing house is there-

fore receivable from the client. It is important to remember that the

firm that has the clearing account, and the broker at the clearing

house is liable for the settlement of £200 whether or not the client

settled their obligation with the broker.

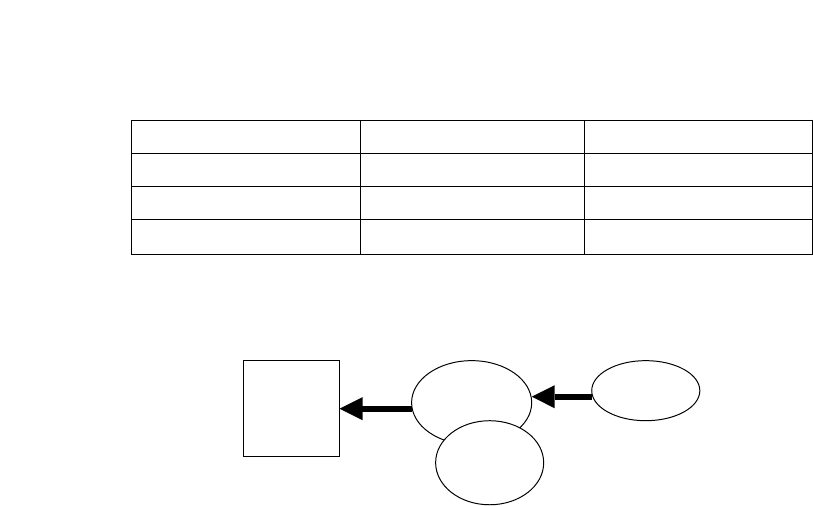

However, if there had been some kind of error with the trade, for

example the price was given to the client as 20p but the actual trade

in the market was 21p, then the transaction would have shown in

the clearing account and backed off in the error account with a

reversal out of the error account backed off to the client account

(Figure 5.5).

The loss of 1p is reflected in the error account and the client

account shows the transaction details as confirmed to the client. In

settlement terms, the amount of £210 due to the clearing house is

being met by £200 from the client and £10 from the error account

(Figure 5.6).

Option exercise and assignment

The buyer of an option has purchased the right to either take delivery

from call or make delivery to put the writer of the option. The under-

lying will be delivered unless the settlement is in cash format rather

than physical.

Options processing 91

Clearing Account Error Account Client Account

Buy 1 BP Oct. 330 Call @ 21p Buy 1 BP Oct. 330 Call @ 21p

Sell 1 BP Oct. 330 Call @ 20p

Buy 1 BP Oct. 330 Call @ 20p

Clearing

house

Clearing

broker

Client

account

Error

account

£10

£200£210

Figure 5.5 Account Postings

Figure 5.6 Account Postings

The terms under which the buyer may exercise their right are deter-

mined by the ‘style’ of the option. As previously noted there are four

styles of options:

1. American – exercisable on any business day

2. European – exercisable on expiry

3. Bermudan – exercisable at preset timings

4. Asian or Average – exercised against an average underlying price.

In the traded option markets, European and American options

are listed. The process for exercising an option is set out in the rules

and regulations of the clearing house and in the contract spec-

ification published by the exchange on which the option is traded.

The clearing house establishes the method and timings for the exer-

cise of options and the clearing members must adhere to these

procedures.

The decision on whether to exercise an option depends on whether

the option has any intrinsic value. Intrinsic value occurs when the

strike price viewed against the current underlying asset price has a

value. For example, if the underlying price is 100 and the strike price

of a call option is 80 then there is an intrinsic value of 20 because

the holder of the option can exercise the right to take delivery of the

underlying at a cost of 80 when it is priced at 100 in the market. The

option is known as an in-the-money option. However, the put option

with a strike price of 80 and an underlying price of 100 is an out-of-

the-money option because it has no intrinsic value as no one would

want to exercise the option to sell the underlying at 80 when they

could sell it in the market at 100.

• In-the-money A call option where the exercise price is below the

underlying asset price or a put option where the exercise price is

above the underlying asset price. These options are deemed to

have intrinsic value of the in-the-money difference between the

exercise price and the underlying asset price.

• At-the-money An option whose exercise price is equal, or closest,

to the current market price of the underlying asset. This option

has little or no intrinsic value as there is no in-the-money differ-

ence between the exercise price and the underlying asset price.

• Out-of-the-money A call option whose exercise price is above the

current underlying asset price or a put option whose exercise

price is below the current underlying asset price. This option has

no intrinsic value.

92 Clearing and settlement of derivatives

Get Clearing and Settlement of Derivatives now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.