8

Stock Valuation

Learning Objectives

![]() List and describe the four types of secondary markets.

List and describe the four types of secondary markets.

![]() Explain why many financial analysts treat preferred stock as a special type of bond rather than as an equity security.

Explain why many financial analysts treat preferred stock as a special type of bond rather than as an equity security.

![]() Describe how the general dividend-valuation model values a share of stock.

Describe how the general dividend-valuation model values a share of stock.

![]() Discuss the assumptions that are necessary to make the general dividend-valuation model easier to use, and use the model to compute the value of a firm's stock.

Discuss the assumptions that are necessary to make the general dividend-valuation model easier to use, and use the model to compute the value of a firm's stock.

![]() Explain why g must be less than R in the constant-growth dividend model.

Explain why g must be less than R in the constant-growth dividend model.

![]() Explain how valuing preferred stock with a stated maturity differs from valuing preferred stock with no maturity, and calculate the price of a share of preferred stock under both conditions.

Explain how valuing preferred stock with a stated maturity differs from valuing preferred stock with no maturity, and calculate the price of a share of preferred stock under both conditions.

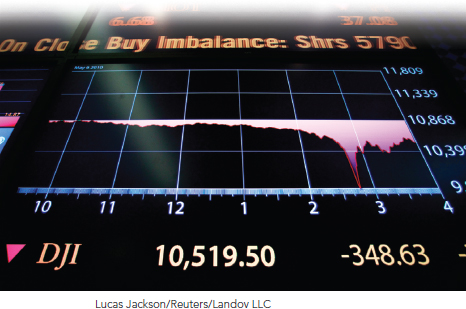

Finding the actual market price of a share of publicly traded stock is easy. You ...

Get Fundamentals of Corporate Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.