CHAPTER 2

The Second Essential: Diversify within Asset Classes

After you've established your asset allocation, the next step is to diversify within each asset class, sometimes called sub-asset allocation or second-tier diversification. In the equity allocation, for example, it means diversifying among large- and small-cap stocks, U.S. and international, and so on. These definitions are not hard and fast. Many people, for example, would consider international stocks a separate asset class.

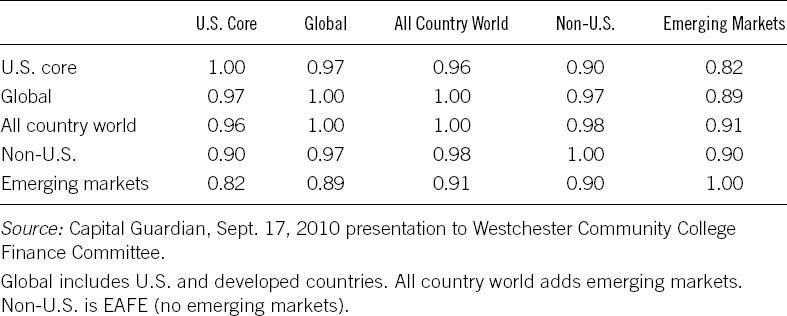

Sub-asset equity allocations have totally different characteristics than asset allocations. In this case, there is a substantial long-run correlation between most sub-asset class correlations. One institutional study found that when correlating five sub-asset equity classes, the lowest correlation of U.S. core stocks to emerging market stocks was a very substantial 0.82. Most correlations ran in the high 0.90s. The following table shows the sub-asset class correlations within the equity asset allocation.

What these facts mean is that determining sub-asset allocations is far less important than determining asset allocations—and probably even less important than selecting individual funds.

This is the part of investing where you can take shortcuts, and do it the easy way.

Equity Correlations, Sub-Asset Allocations

Diversify Stocks with Broad-Based Index Funds

The best way to begin the sub-asset allocation ...

Get Investing without Wall Street: The Five Essentials of Financial Freedom now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.