CUTTING THE TAILS OF A SYSTEM'S DISTRIBUTION

Cutting Losses

One potential drawback to all indicator-driven trend-following systems is that losses tend to fluctuate on a daily basis and can be quite large if realized immediately following entry. An obvious solution to this problem is the introduction of the same type of loss limits (e.g., percentage of asset's value at entry) examined in our discussion of channel breakout filters. I strongly encourage readers to experiment with various methods of cutting off the left (or loss) tail of their trend-following system's distribution, especially if the system is intermediate to long term and per-trade losses suffered would otherwise be large in relation to average per-trade profits.

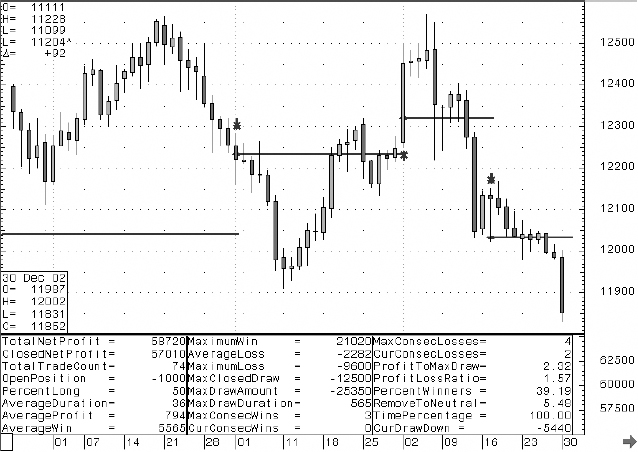

Figure 3.3 shows the backtested results from a simple stop-and-reverse 20-day channel breakout system; Figure 3.4 shows the same system with a stop-loss filter of 3 percent of asset value at entry.7

Although at first glance the simple stop and reverse channel breakout appears superior since it generated a larger total net profit, notice that the profit to maximum drawdown (P:MD) for the system with the stop loss is larger and the time percentage required to achieve this same P:MD is smaller. Therefore, the addition of the stop loss yielded a greater return vis-à-vis risk while tying up less investor capital over time.

FIGURE 3.3 Spot U.S. dollar/yen with 20-day ...

Get Mechanical Trading Systems: Pairing Trader Psychology with Technical Analysis now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.