Introduction

Like thousands of other people, you hope Quicken can help you control your mountains of financial information—credit cards, tax deductions, loans, retirement plans, and assets. You want a program that gives you an overview of your financial health, while sparing you the time and tedium of balancing your checkbook and tracking every investment by hand. As you’ll discover in this book, Quicken can do all that and more. Its hundreds of features share one common purpose: to help you manage your personal finances. If you have trouble remembering to transfer extra cash into higher-interest-rate savings, for example, Quicken can remind you. If budgets are your downfall, Quicken can take your financial goals and help you build a budget to achieve them.

Quicken isn’t hard to learn. Using the program as an electronic checkbook isn’t much different from recording checks and deposits in a paper register. Features and techniques that you’re familiar with from other programs work just as well in Quicken, including windows, dialog boxes, drop-down menus, and keyboard shortcuts. Best of all, once you enter a bit of financial information into Quicken—like a check, deposit, credit card transaction, or loan payment—you never have to type it again. Quicken can use that information over and over to calculate things like budget averages, debt balances, or even your net worth. Every minute you spend learning the program is time well spent.

Your Quicken ambitions may be no bigger than balancing your checkbook. Yet somehow, the program gets you thinking about aspects of your personal finances that you were content to completely ignore in the past. As you learn to do more with Quicken, you’ll expand your knowledge and ideas about money. Then again, sometimes Quicken seems to raise more questions than it answers: Return of capital from stock—what’s that? What does “net worth” mean anyway—and why do you need to know it? Luckily, the book you’re holding picks up where Quicken’s help resources leave off.

This book begins by telling you how to set up Quicken to fit your needs. It explains the program’s basic features and answers questions you’re likely to have (but Quicken Help doesn’t answer). If speed is your thing, this book shows you the fastest ways to perform financial tasks—like keyboard shortcuts. It also provides comprehensive discussions and step-by-step tutorials for people who need a bit of handholding. Along the way, you’ll discover a few features and benefits most Quicken owners never knew existed.

Personal Finance and Quicken

Quicken is more than an electronic checkbook—it’s a personal finance management program. Sure, the register you use to record transactions electronically looks like your paper register. But by harnessing the power of your PC and the Internet, Quicken opens up new horizons for performing financial tasks more quickly and easily.

What Quicken Does

Perhaps the first benefit you’ll come to know and love is that you no longer have to worry about arithmetic. Quicken automatically updates your account balances when you record transactions, calculates the remaining funds when you divvy up a paycheck, matches downloaded transactions to recorded ones, and tells you when you’ve successfully reconciled your account.

Because Quicken can categorize every transaction, collecting your tax-related information and building a budget are no longer frantic treasure hunts through shoeboxes of paper. Instead, a few quick clicks produce the information you need—ready to print out or feed into another of Quicken’s features. You can also export tax-related data to programs like Turbo Tax. You can then import your tax return results into Quicken to plan next year’s tax strategy.

Quicken doesn’t just track what you’ve done with your money in the past. The program’s planning features help you decide what to do with your money in the future. From simple reminders to pay credit card bills on time and avoid late fees to portfolio reports that show you whether your investments are working as well as they could be, Quicken is bursting with tools to improve your financial situation.

What Quicken Doesn’t Do

Quicken isn’t a true bookkeeping or accounting program. Although the Quicken Premier Home & Business edition offers business features like invoices, accounts receivable, and payroll, it doesn’t offer ledgers, true double-entry accounting, a chart of accounts, inventory control, or certain financial reports that accountants and the IRS need. For example, because Quicken doesn’t include equity accounts, you can’t generate a balance sheet like the ones your accountant is used to. (However, Quicken’s “Income and Expense by Category” report can pass as a profit-and-loss report or income statement.)

If you have a small business and you don’t track inventory or generate standard financial reports, you can get by with Quicken Premier Home & Business. However, if you work with a bookkeeper or accountant, you’ve no doubt heard pleas to switch to QuickBooks, Intuit’s small-business accounting program—and it’s generally a good idea to listen. Yes, QuickBooks costs a bit more and dumps you unceremoniously into the Scylla and Charybdis of debits and credits. But if you pay your accountant for advice and she’s willing to help you get started with QuickBooks, the transition won’t be painful. (And you may find features in QuickBooks that can help you become even more productive.)

Quicken and Accounting

Although Quicken isn’t an accounting program, it does perform some accounting tasks. If your financial horizon is no further than your next paycheck, some of Quicken’s features may seem like mystical arts. Yet, in a cruel twist, Quicken’s accounting features are equally mysterious to those who are familiar with accounting. Here’s a quick overview of how Quicken accounts for your money.

Accounts versus categories

Assets are things you own, like checking accounts, certificates of deposit, brokerage accounts, a house, and your car. Quicken includes several types of accounts for your assets: checking, savings, house, vehicle, and a generic asset account for assets that don’t fall under any of the other account types (like the Faberge egg your Aunt Katrinka left you in her will). Furniture and clothing are assets as well, although most folks don’t bother tracking them in Quicken.

Liabilities are what you owe to others, like credit cards, mortgages, and other types of loans. Quicken includes liability accounts to cover every type of debt you carry.

In business accounting, income accounts track money that an organization receives, whether from selling services, selling products, or obtaining research grants. Expense accounts track money the organization spends, like employee salaries, office rent, and accountants’ fees. Quicken, by contrast, doesn’t have income and expense accounts. Instead, you create income and expense categories. When you record a check, charge, or deposit—in fact, any kind of transaction—you assign the money to one category or another.

Following the money

Business accounting uses double-entry accounting, in which every transaction represents a debit in one account and a credit to another account. Although accountants, bookkeepers, and other financial geeks can spot debit entries and credit entries from a mile away, the rest of us don’t need that kind of detail.

Quicken takes a more intuitive approach that only partially mimics double-entry accounting. For example, in Quicken, credit cards act like negative cash, which is an appropriate way to think about it. Whether you spend cash or credit card debt, you’re nibbling away at your bottom line. When you pay your credit card bill, Quicken deducts cash from your checking account and adds it to the credit card account, thereby decreasing the balance owed.

Equity

In business accounting, anything worth tracking goes into a separate account, even the difference between the value of your assets and liabilities. An equity account is the holding place for that difference. In business, the financial report called a balance sheet gets it name because the total for all of the asset accounts equals the total of all of the liability accounts and equity accounts.

Quicken doesn’t have equity accounts, but it can still calculate your net worth, which is your total assets minus your total liabilities. In other words, it’s the value of everything you own after paying off all your debts. Net worth is as important in personal finances as equity is in business. Increasing the value of what you own while decreasing the amount you owe increases your net worth—a goal that helps you achieve all those other goals in life. (Quicken displays your net worth in the Quicken Home window to remind you of your progress.)

Choosing the Right Quicken Edition

Unlike QuickBooks, its small business accounting cousin, Quicken comes in only three editions. Deciding which one suits you is relatively easy. Here’s an overview of what each edition does:

Quicken Deluxe ($49.95) handles all the basic personal finance tasks, from tracking cash to budgeting, paying bills, and tracking your investments. If you plan to use the program to track your spending, gather your tax data, track investments, and do a little planning, Deluxe is all you need.

Quicken Premier ($69.95) is for people who are more serious about their investing. This edition does everything that Quicken Deluxe does, but throws in additional investment portfolio tools. It also offers to help find tax deductions you may have missed.

The only reason you’d spring for Quicken Premier Home & Business ($79.95) is if you run a small business and want to track both your personal and business finances with the program. This edition contains everything that the standard Quicken Premier offers, but adds payroll, accounts receivable, invoicing, and mileage tracking.

Tip

If you track inventory, handle payroll for more than a few employees, or need financial reports formatted to the typical accounting standard, consider forking over the extra cash to purchase Intuit’s QuickBooks product. Intuit offers Simple Start to first-time QuickBooks users for $99.95 (only $20 more than Quicken Premier Home & Business). QuickBooks Pro, the most inexpensive edition, costs $199.95 ($99.95 for upgrades from previous versions).

What’s New in Quicken 2006

Most of the time, new versions come with enhancements, timesaving features, and more online tools to make your work easier and faster. You don’t have to upgrade every year, but Intuit drops support for versions older than three years. With a rebate for existing customers, upgrading doesn’t cost all that much for the benefits you receive.

Some changes take some getting used to. Not that long ago, Intuit changed the way budgeting worked and completely overhauled the investment register. For some changes, it simply takes some time to learn how to make the most of the new techniques, as was the case with budgeting. Other changes are more like Coke Classic. Customers provided copious feedback and Intuit responded by resurrecting or reworking the features it removed.

Quicken 2006’s changes fall more in the evolutionary than revolutionary camp, but a few additions might make you sit up and take notice:

Storing electronic statements and other images. With Quicken 2006, you can link electronic statements from your real-world accounts to the corresponding accounts in your Quicken data file. For example, you can download an electronic checking account statement and store it with your checking account in Quicken. If a question arises about a transaction, you can remain resolutely seated in your computer chair instead of bouncing back and forth between your desk and filing cabinet.

You can also store electronic files with transactions; link images of canceled checks to your check transactions; store downloaded or scanned receipts with purchase transactions for proof of purchase; and store with transactions the receipts, warranties, and other material that you tend to forage for. When you need information, Quicken has it all.

Saving reports as PDF files. For people tracking only personal finances, this feature is helpful from time to time—to send financial information to your accountant or financial advisor at tax time or when updating your financial plan. This feature is handy more often for those using Quicken Premier Home & Business for electronically transmitting invoices, business forms, and reports to customers and business associates.

Entering investment transactions in the investment register. Intuit eliminated this option at one point, only to bring it back by popular demand. In Quicken 2006, you can once again enter and edit investment transactions via the register (or a dialog box if you prefer).

About This Book

Despite the many improvements in Quicken over the years, one feature has grown consistently worse: Intuit documentation. For a topic as complicated as personal finance, all you get with Quicken is an electronic copy of Getting Started with Quicken, which is little more than a guide to tasks Quicken performs, with a few step-by-step instructions.

Even if you don’t mind reading instructions in one window as you work in another, you’ll quickly discover that Quicken Help is hardly worth the screen space it consumes. The help topics often cover the basic material you already know, but fail to answer the burning questions that made you launch Help in the first place. In addition, Quicken Help rarely tells you why you might want to use any feature. And underlining key points, jotting hard-earned insights in the margins, and reading about Quicken while sitting by the pool are out of the question.

Quicken 2006 for Starters: The Missing Manual is the book that should have come with Quicken 2006. Although each version of Quicken introduces new features and enhancements, you’ll still find this book useful if you’re tracking your finances in an earlier version of Quicken. (Of course, the older your version of the program, the more dissimilarities you’ll run across.)

Note

This book covers the Windows version of Quicken. The program’s development for the Mac was completely separate—and different—from the ground up. Accordingly, Quicken differs significantly on the two platforms.

In this book’s pages, you’ll find step-by-step instructions for using the most popular and useful Quicken features, including those you may not have quite understood, let alone mastered: budgeting (Chapter 8), recording investment transactions (Section 1.5.5), archiving Quicken data files (Section 3.1), and so on. Along the way, the book helps you evaluate Quicken’s features and decide which ones would be most useful in your situation.

Quicken 2006 for Starters: The Missing Manual is designed to accommodate readers at every technical level. The primary discussions are written for beginner or intermediate Quicken users. But if you’re a first-time Quicken user, special boxes with the title “Up To Speed” provide the introductory information you need to understand the topic at hand. On the other hand, advanced users should watch for similar shaded boxes called “Power Users’ Clinic.” These sidebars offer more technical tips, tricks, and shortcuts for the experienced Quicken fan.

About the Outline

Quicken 2006 for Starters: The Missing Manual is divided into three sections, each containing several chapters:

Chapters 1, 2, and 3 cover everything you must do to set up Quicken based on your own needs. These chapters explain how to create a Quicken data file, create accounts and categories, configure preferences, and protect your financial information.

Chapters 4, 5, 6, and 7 follow your money from the moment you earn it to when you report your financial activities to the IRS. These chapters describe how to make deposits, pay for expenses, track the things you own and how much you owe, perform financial tasks online, reconcile your accounts, and care for your Quicken data file.

Chapter 8, 9, and 10 elucidate some of the features that help you increase your financial success. These chapters explain how to create and use budgets, track investments, and generate Quicken reports to prepare your tax returns or evaluate the state of your financial fitness.

At the end of the book, two appendices provide a quick review of the most helpful keyboard shortcuts and a reference to help resources for Quicken.

Tip

This book includes four bonus appendices that you can download in PDF format for printing or reading on your PC. They include a guide to installing and upgrading Quicken (Appendix C), importing and exporting Quicken data (Appendix D), maintaining your Quicken data file (Appendix E), and a bunch of cool techniques and under-appreciated features like Quicken email and the Pin Vault (Appendix F). Go to http://www.missingmanuals.com/cds and click this book’s link, then click the link for each appendix to download it to your PC.

The Very Basics

To use this book, and indeed to use Quicken, you need to know a few basics. This book assumes that you’re familiar with a few terms and concepts:

Clicking. This book gives you three kinds of instructions that require you to use your computer’s mouse or track pad. To click means to point the arrow pointer at something on the screen and then—without moving the pointer at all—press and release the left button on the mouse (or laptop track pad). To double-click, of course, means to click twice in rapid succession, again without moving the pointer at all.

When you’re told to Shift-click something, you click while pressing the Shift key. Related procedures, like Ctrl-click, work the same way—just click while pressing the corresponding key.

To right-click, you do the exact same thing, but pressing the right mouse button instead. Usually, clicking with the left button selects an onscreen element or presses a button onscreen. A right-click usually reveals a shortcut menu, which lists some common tasks specific to whatever you’re right-clicking on.

Dragging. To drag means to move the pointer while holding down the (left) button the entire time. To right-drag, of course, means to do the same thing but holding down the right mouse button.

Menus. The menus are the words at the top of your screen: File, Edit, and so on. Click one to make a list of commands appear, as though they’re written on a window shade you’ve just pulled down.

Some people click to open a menu and then release the mouse button; after reading the menu command choices, they click the command they want. Other people like to press the mouse button continuously as they click the menu title and drag down the list to the desired command; only then do they release the mouse button. Either method works, so choose the one you prefer.

Keyboard shortcuts. Nothing is faster than keeping your fingers on your keyboard, entering data, choosing names, triggering commands—without losing time by grabbing the mouse and then selecting a command or list entry. That’s why many experienced Quicken fans prefer to trigger commands by pressing combinations of keys on the keyboard. When you read an instruction like “Press Ctrl+J to open the Scheduled Transactions List window,” start by pressing the Ctrl key; while it’s down, type the letter J, and then release both keys.

About → These → Arrows

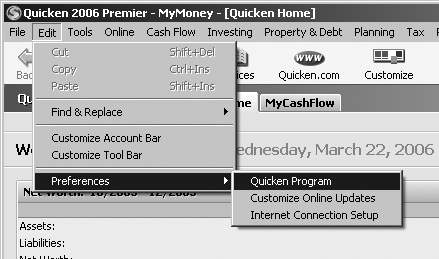

Throughout this book, and throughout the Missing Manual series, you’ll find sentences like this one: “Choose Edit → Preferences → Quicken Program.” That’s shorthand for a much longer instruction that directs you to navigate three nested menus in sequence, like this: “Choose Edit. On the Edit menu, point to the Preferences menu entry. On the submenu that appears, choose Quicken Program.” Figure I-1 shows the menus this sequence opens.

Similarly, this arrow shorthand also simplifies the instructions for opening nested folders, like My Documents → Quicken Data → Backup.

About MissingManuals.com

At http://www.missingmanuals.com, you’ll find news, articles, and updates to the books in this series. The Web site also offers corrections and updates to this book (to see them, click the book’s title, and then click Errata). In fact, you’re invited and encouraged to submit such corrections and updates yourself. In an effort to keep the book as up to date and accurate as possible, each time we print more copies of this book, we’ll make any confirmed corrections you’ve suggested. We’ll also note such changes on the Web site, so that you can mark important corrections into your own copy of the book, if you like.

In the meantime, we’d love to hear your suggestions for new books in the Missing Manual line. There’s a place for that on the Web site, too, as well as a place to sign up for free email notification of new titles in the series.

Safari® Enabled

When you see a Safari® Enabled icon on the cover of your favorite technology book, that means it’s available online through the O’Reilly Network Safari Bookshelf.

Safari offers a solution that’s better than e-books: it’s a virtual library that lets you easily search thousands of top tech books, cut and paste code samples, download chapters, and find quick answers when you need the most accurate, current information. Try it for free at http://safari.oreilly.com.

Get Quicken 2006 for Starters: The Missing Manual now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.