THE CASH PROBLEM

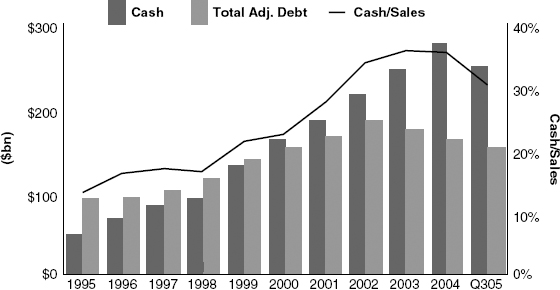

The costs of holding too much cash are more apparent than ever in this low interest rate environment: a low rate of return earned, double taxation of interest income, and the temptation to waste cash on low return investments (agency costs). Conventional wisdom has companies go to great lengths to minimize cash balances because you cannot earn your after-tax WACC on cash balances. Most favor near-cash equivalents in the form of undrawn lines and commercial paper (CP) access to provide event risk liquidity. Cash balances are at historic highs and growing despite a growing wave of distributions. Figure 8.2 illustrates for the technology sector, where the cash problem has been epidemic.

FIGURE 8.2 Technology Sector Cash and Debt

Liquidity helps offset volatile operating cash flows or interest rate volatility. It is more important than ever before and its cost remains small. The cost of strong liquidity can be a fraction of the economic value it supports. Operating cash levels help minimize the transaction costs associated with raising funds and support important investment funding when it might otherwise be unavailable or would be prohibitively expensive. Liquidity reduces the risks that stem from markets closing to the issuer: refinancing risk.

Liquidity can have a strategic rationale in the signaling value it offers to comfort customers, warn competitors, or provide ...

Get Strategic Corporate Finance: Applications in Valuation and Capital Structure now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.