CAPITAL STRUCTURE SOLUTIONS

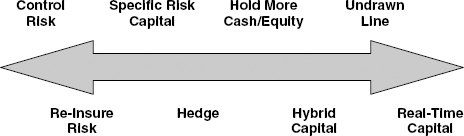

Companies face a wide spectrum of potential responses to risk (Figure 10.4), all of which have capital structure implications due to the interchangeability of these alternatives. They range from avoiding and laying off risks, to hedging risks or capital structure solutions to cope with residual risk. Capital structure solutions might involve simply holding more (excessive cash/equity reserves) capital, using more cost-effective hybrid capital, or creating options on contingent capital, to manage event risk.

FIGURE 10.4 Strategic Risk Management Spectrum

With advances in capital markets technologies, we have witnessed a resurgence of interest in the economic substitution of risk management for equity, which de-risks business assets and cash flows to create more debt capacity to repurchase equity, described in more detail for the case of corporate pensions in the final chapter of this book.

Control (Avoid/Mitigate)

Controlling risk by avoiding or mitigating exposures is the first choice to consider though the needs of the business will often make this alternative impractical. Many operational risks can be avoided or mitigated through the Six Sigma process control initiatives briefly outlined earlier. Business reasons make financial risks generally more difficult to avoid, and exposure to business markets will create natural exposures to currencies, commodities, ...

Get Strategic Corporate Finance: Applications in Valuation and Capital Structure now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.