WHICH “EXPOSURE” TO HEDGE

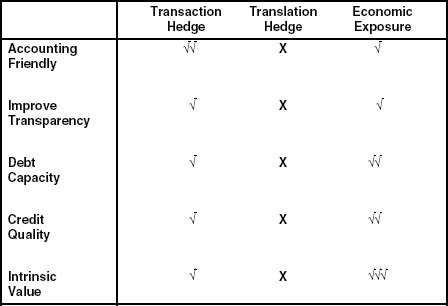

Many companies have responded to increased exposures and risk with more resources (i.e., people and capital) devoted to risk management. But to develop an effective risk management strategy, there must first be agreement in the definition and determination of the exposures. And yet, there is a major discrepancy between accounting practice and economic reality in terms of what constitutes an exposure. In practice, the term exposure remains open to wide variation in interpretation, frequently leading to differences in opinion at the Board of Directors level around appropriate policy and action. We outline the most frequent types of exposure (i.e., transaction, translation, and economic) below (Figure 11.1).

FIGURE 11.1 Hedging Alternative Exposures

Transaction Hedging

Transaction exposure most frequently arises from revenues and costs in nonlocal currencies. Anticipated transaction currency exposure hedging is common and, if properly structured, is allowed and treated favorably by Financial Accounting Standards (FAS) 133. However, recent volatility of the USD against other major currencies may have driven some hedges deep into or out of the money—rendering them less effective. Companies may consider restructuring hedge books to avoid unwanted cash flow and earnings events.

Most companies start out with simple transaction exposures, stemming from the possibility ...

Get Strategic Corporate Finance: Applications in Valuation and Capital Structure now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.