CHAPTER 5 Business Investment This Time is Different

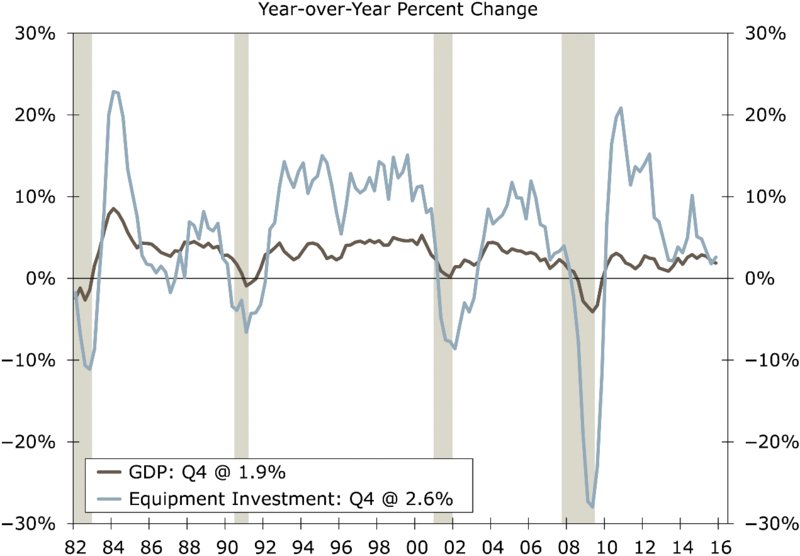

Capital investment is a critical component of long-run economic growth. The growth rate of the capital stock has implications for the pace of gains in labor productivity and long-run potential growth, which is fundamental to improving standards of living in an economy. In addition, although business investment comprises a smaller share of gross domestic product (GDP) than consumption, it is highly cyclical and can be a leading indicator for turns in the business cycle (Figure 5.1). In this chapter, we highlight the drivers of business investment spending and how the behavior of capital investment has changed following the Great Recession.1 It is clear that business investment has disappointed for much of this cycle. Despite a rapid rebound initially following the large declines seen in the recession, equipment has been frustratingly slow during this expansionary period.

Figure 5.1 Real GDP and Equipment Investment

Source: U.S. Department of Commerce

DRIVERS OF BUSINESS SPENDING

Investment spending directly impacts the capital stock; therefore, businesses’ investment decisions are related to their desired capital levels. Recall that the change in the capital stock (![]() ) from one period to another is equal to net investment, ...

) from one period to another is equal to net investment, ...

Get Economic Modeling in the Post Great Recession Era now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.