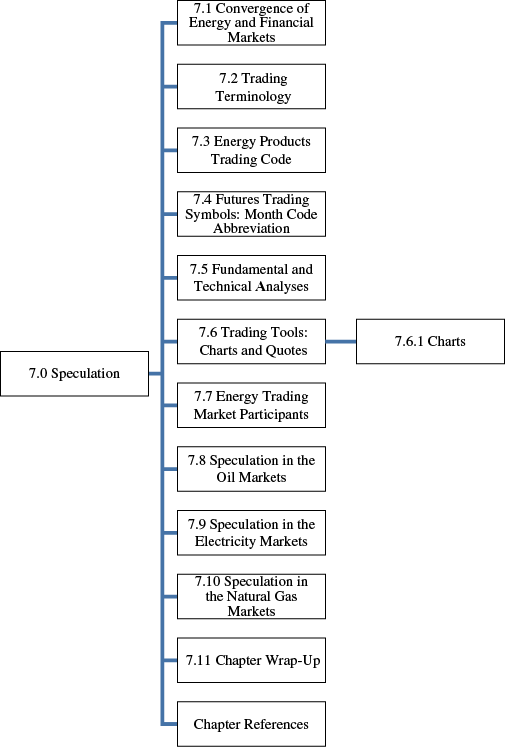

CHAPTER 7 Speculation

In this chapter we will discuss the role speculators play in the energy markets. To accomplish this task we will

- Introduce additional derivatives and trading terminology and notation.

- Present a comparison of speculation and hedging.

- Discuss how traders may incorporate fundamental and technical analysis into their trading strategies to analyze energy markets.

- Define and illustrate trading resources and tools, such as charts and quotes.

- Present illustrations of speculative trading in the oil, natural gas, and electricity markets.

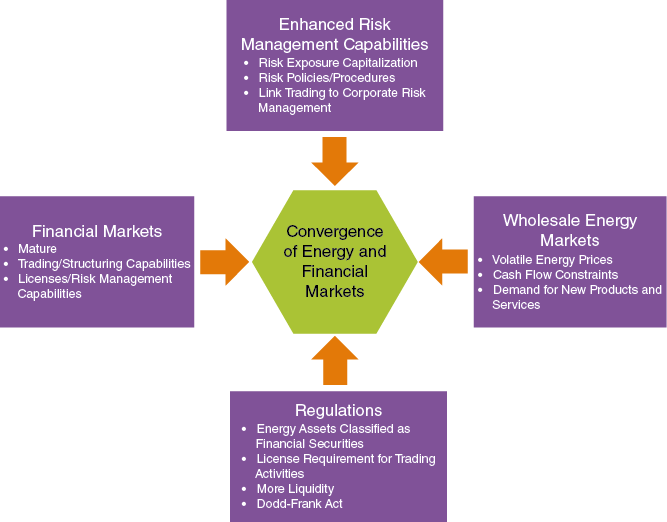

7.1 CONVERGENCE OF ENERGY AND FINANCIAL MARKETS

Various market forces have caused a shift in the balance of power between incumbent energy market participants and new energy trading market entrants (Figure 7.1).

FIGURE 7.1 Convergence of Energy and Financial Markets

- Price volatility fuels demand for new energy products and services.

- Regulatory changes affect the playing field between banks and energy market participants.

- Risk management tools provide additional insurance to energy market participants.

As a result of these market forces, we are seeing a convergence of financial and energy markets (Carpenter 2007).

Trading is a voluntary exchange of goods and/or services. These exchanges can take place between two parties ...

Get Energy Trading and Risk Management: A Practical Approach to Hedging, Trading and Portfolio Diversification now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.