LEARNING OBJECTIVES

After studying this chapter, you should be able to:

- 1 Describe the formal procedures associated with issuing long-term debt.

- 2 Identify various types of bond issues.

- 3 Describe the accounting valuation for bonds at date of issuance.

- 4 Apply the methods of bond discount and premium amortization.

- 5 Explain the accounting for long-term notes payable.

- 6 Describe the accounting for the extinguishment of non-current liabilities.

- 7 Describe the accounting for the fair value option.

- 8 Explain the reporting of off-balance-sheet financing arrangements.

- 9 Indicate how to present and analyze non-current liabilities.

Going Long

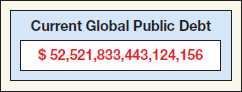

The clock is ticking. Every second, it seems, someone in the world takes on more debt. The idea of a debt clock for an individual nation is familiar to anyone who has been to Times Square in New York, where the American public shortfall is revealed. The world debt clock shown below (accessed in January 2014 at www.nationaldebtclocks.org) indicates the global figure for almost all government debts in dollar terms.

Does it matter? After all, world governments owe the money to their own citizens, not to the Martians. But the rising total is important for two reasons. First, when government debt rises faster than economic output (as it has been doing ...

Get Intermediate Accounting: IFRS Edition, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.