When you have very exacting criteria for the stocks you want, define your own criteria with an industrial-strength screening tool.

Preformatted stock screening tools [Hack #4] are great for quick and easy filtering, but you’re limited to the financial fields and the criteria tests that they provide. When you want to define sophisticated screens, in which you combine tests or screen with numerous financial measures, you need a screening tool that provides access to dozens of financial measures, and includes arithmetic and logical operators for comparing multiple measures. You might expect to pay for a tool with this kind of power and, in some cases, you would be correct. However, the best industrial-strength stock screening tools are free.

The same web sites that bring you basic stock screens often provide more sophisticated screening tools for the overachievers in the audience. Although MSN Money’s basic screener is lame, their Deluxe Screener rules. Reuters Investor doesn’t offer much in the basic screen department either, but the Reuters Power Screener lives up to its name. Although Morningstar and Hoover’s both offer industrial-strength screening tools, they don’t offer enough additional features to justify the price tag they carry. In the for-a-fee category, stock screening software applications sometimes offer advantages over online tools that might make them worth the price.

- MSN Money Deluxe Screener (http://money.msn.com/investor/finder/customstocks.asp)

With the MSN Money Deluxe Screener, you can build screens from hundreds of financial measures and ratios. Selecting fields, operators, and values from pull-down menus or simply typing values in boxes makes it easy to define your criteria. In a criterion, you can specify a numeric value or compare a company’s performance to the industry average [Hack #23] . In addition, you can define a criterion so that the screener prompts you for a value. For example, if you screen for different growth rates, use a prompt instead of creating multiple screens for each growth rate you use.

You can save the screens you build to run again. You can also export screen results to an Excel spreadsheet or comma-delimited file, and you can export the symbols for the resulting companies to MSN’s Portfolio Manager. You can specify the financial measures that appear in the results table. To evaluate the screened companies with companies that don’t appear in the results, type the ticker symbol for the missing company in the Compare With box.

Best feature: when you type a ticker symbol in the Stock Matcher tool, it configures the screening tool with criteria based on the financial values for the company you specified and finds similar companies.

Worst feature: for fundamental investors, this screen provides five-year revenue growth but not five-year EPS growth.

Tip

The MSN Money Deluxe Screener requires some software on your computer. To load the deluxe tool, click the Deluxe Stock Screener link at the bottom right of the web page and follow the instructions. A graph appears on the download web page to indicate that the installation was successful. When you click the Custom Search link in the navigation bar, the Deluxe Screener appears instead of the basic screening form.

- Reuters Investor Power Screener (http://www.reuters.com/finance.jhtml)

For the screening connoisseur, the Reuters Investor Power Screener can’t be beat, but be forewarned: it isn’t as easy to use as the MSN Deluxe Screener. Reuters provides a tutorial for the tool if you need help. The Power Screener provides dozens of financial measures and ratios, although it lacks several that many fundamental investors would like to see. You can define your own variables by defining formulas with financial measures, and arithmetic or logical operators. For example, you can create a user-defined variable for the PEG ratio [Hack #28] by dividing the built-in variable for the P/E ratio by the built-in variable for EPS growth.

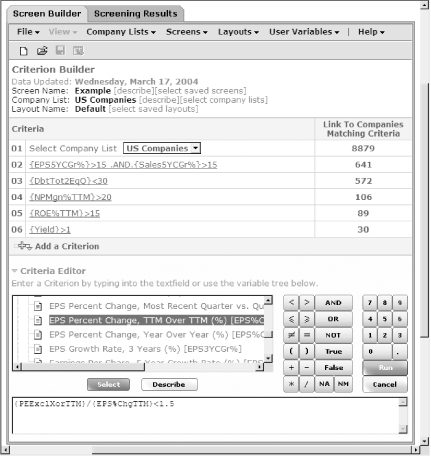

To define criteria, choose variables, operators, logical operators, and values, as shown in Figure 1-5. You can create criteria with multiple tests, such as a criterion that looks for companies whose sales and EPS growth rates are both greater than 15 percent. To save yourself a few steps, you can base your screen on one of the built-in screens and modify the criteria you want. When you click Run, the screen adds the criterion to the stock screen and shows you how many companies passed the existing set of criteria. Continue to add criteria until you have the number of results you want to work with. You can view either the screen criteria or the companies that meet those criteria by selecting the Screen Builder and Screening Results tabs, respectively.

You can save the screens you build to run again; save the results as a list of companies for future evaluation, or export the results to an Excel spreadsheet. In addition to choosing the financial measures that appear in the results table and the order in which they appear, you can choose to display statistics such as the average, maximum, or minimum values for columns. The modifications you make to the columns that appear can be saved as a layout, so different screens can display different fields for the results. You can also add individual companies to the results list.

Best feature: it provides the most capabilities of the free industrial-strength screening tools.

Worst feature: it’s about as easy to use as the programming features on circa 1980 VCRs.

Tip

To access the Power Screener, navigate to http://www.reuters.com/finance.jhtml, click Ideas & Screening in the navigation bar in the left margin, and then click PowerScreener in the navigation bar.

- NAIC Stock Prospector (http://www.better-investing.org/about/software/prospector.html)

Stock Prospector is a software application that runs on your computer. It searches the data available through NAIC Online Premium Services [Hack #20] or other data in NAIC’s .ssg file format to find companies that meet your criteria. Features not available in online screening tools include weighted screens based on growth, value, quality, and safety; the capability of weighting and ranking individual criteria; advanced customization features; customizable reports; and more than 100 industry average measures for comparing companies to industries.

Best feature: miniature Stock Selection Guide graphs that highlight key company performance and help you decide whether to evaluate a company further.

Worst feature: it’s not a biggie, but the software costs $59 and NAIC Online Premium Services costs an additional $25 per year.

- AAII Stock Investor Professional (http://aaii.com/store/sipro/)

Stock Investor Professional contains both data and a screening tool. You receive a CD each month with the screening software and updated data for more than 2,000 data fields per company. The screening tool includes powerful features similar to those available with Stock Prospector. AAII provides additional data, such as percentile rankings and numbers from company cash flow and income statements.

Best feature: you can screen for data fields not available with any of the other tools.

Worst feature: data and software costs $247 per year ($198 for AAII members).

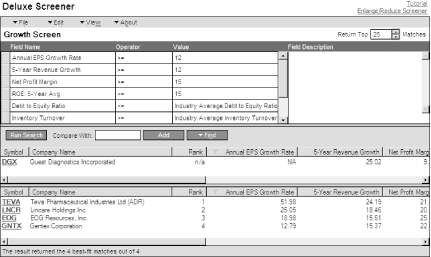

Because the Deluxe Screener has more features than basic online tools, let’s use an example of a high-quality growth screen to try it out. For example, to find companies that have been growing at a strong pace that also exceed the industry average in key financial measures, we can use the following criteria:

Annual EPS growth rate greater than 12 percent

Five-year revenue growth greater than 12 percent

Net profit margin greater than 15 percent

Five-year average return on equity (ROE) greater than 15 percent

Debt to equity ratio less than the industry average

Inventory turnover greater than industry average

P/E ratio greater than 5 and less than 30

To work with the Deluxe Screener, follow these steps:

After installing the plug-in required on your computer, navigate to http://money.msn.com/investor/finder/customstocks.asp and click Custom Search in the navigation bar to open the Deluxe Screener.

To start a new screen, choose File→New on the Deluxe Screener menu bar.

To define the Annual EPS growth rate criterion, click the first Field Name box and choose Growth Rate→Annual EPS Growth Rate. Click the first Operator box and choose >=. Click the first Value box once to select it, click a second time, and then type

12.To define the five-year revenue growth criterion, click the next Field Name box and choose Growth Rate→5-Year Revenue Growth. Click the first Operator box and choose >=. Click the next Value box once to select it, click a second time, and then type

12.To define the net profit margin criterion, click the next Field Name box and choose Profit Margins→Net Profit Margin. Click the next Operator box and choose >=. Click the next Value box once to select it, click a second time, and then type

15.For ROE, click the first Field Name box and choose Investment Return→ROE: 5-Year Avg. Click the next Operator box and choose >=. Click the next Value box once to select it, click a second time, and then type

15.For the debt to equity ratio, click the first Field Name box and choose Financial Condition→Debt to Equity Ratio. Click the next Operator box and choose <=. Click the next Value box and choose Financial Condition→Industry Average Financial Condition.

For inventory turnover, click the first Field Name box and choose Mgmt. Efficiency→Inventory Turnover. Click the next Operator box and choose >=. Click the next Value box and choose Mgmt. Efficiency→Industry Average Inventory Turnover.

To screen a field for a range of values, you must define two criteria. To define the criteria for the P/E ratio, follow these steps:

Click the first Field Name box and choose Price Ratios→Price Ratio: Current. Click the next Operator box and choose >=. Click the next Value box twice and then type

5.Click the first Field Name box and choose Price Ratios→Price Ratio: Current. Click the next Operator box and choose <=. Click the next Value box twice and then type

30.

The Deluxe Screener runs the search each time you complete a criterion and shows the results as illustrated in Figure 1-6. However, to refresh the search, click Run Search.

To save the screen, choose File→Save (in the Screener, not your browser). Type the name of the screen and optionally a description of the screen criteria. Click OK.

Tip

To use a saved screen at a later time, choose File→Open, expand the My Saved Searches folder in the Finder Search box, select the screen you want to use, and click Open and Run or Open and Edit.

You can modify a screen in numerous ways and perform other administrative tasks before or after you save the screen, including the following:

To sort the results, click the heading for the column you want to sort by. The sort order toggles between ascending and descending.

To modify the search criteria, make the changes you want to the criteria and click Run Search again.

To change the columns of data displayed or the order in which they appear, choose View→Column Set Displayed→Customize Column Set. You can add or remove columns. To reorder the columns, select one in the Displayed Columns list and click Move Up or Move Down.

To export the screen results to a spreadsheet, choose File→Export→Results to Excel. Click OK.

To add the ticker symbols for the results to a portfolio in MSN Portfolio Manager, choose Edit→Add All Symbols to Portfolio Manager.

To compare values with a company not in the screen results, type the company ticker symbol in the Compare With box and click Add. The company appears in the Comparison pane as shown in Figure 1-6.

Get Online Investing Hacks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.