Narrowing the stock field down to a handful of attractive candidates is easy with many of the online stock screening tools.

With over 10,000 publicly held companies available as investments, you need some help whittling the field down to a few companies for further study. Many companies aren’t good investments. Some don’t grow enough. Some don’t grow at all. Others are growing, but cost too much to offer you a sufficient investment return. Others are growing and reasonably priced, but too risky for your peace of mind. Weeding out all these companies typically narrows your candidates significantly. In addition, you can narrow the field further if you’re looking for companies in specific industries or with a particular market capitalization to satisfy your portfolio diversification objectives [Hack #74] . It doesn’t do much good to identify desirable characteristics, unless there’s an easy way to filter the list for stocks that possess those features. Fortunately, that’s exactly what stock screening does, and free stock screening tools abound on the Web.

Stock screening tools are black and white. When you define a criterion, a company either meets it or doesn’t. For example, if you screen for EPS growth rate of greater than 15 percent, a company growing at 14.9 percent won’t show up. Overly rigorous screening criteria might weed out companies that you should consider. One way to correct this failing is to adjust your criteria until the screen returns eight to twelve stocks. Then, you can compare the companies’ financial measures [Hack #6] to identify the three or four you want to study in depth.

Don’t try to screen all the way to the final four stocks for your in-depth study and under no circumstance screen to only one stock! Keeping your criteria more flexible enables you to catch companies that don’t quite fit your criteria but are worth consideration, such as high-quality companies that are currently overpriced. Besides, companies are more than their numbers [Hack #45] . For example, a stock screen can find companies with attractive historical earnings and sales growth, but it can’t tell you which companies are positioned to continue their growth into the future.

Every comprehensive financial web site worth its salt offers stock screening tools, most at no charge. In fact, most of these sites provide several types of screening tools including predefined stock screens, easy-to-use screening forms on a web page, and sophisticated criteria builders that enable you to create highly customized screens [Hack #5] . Table 1-5 summarizes the features available for the best fast and free online screening tools.

Table 1-5. The best tools for screening stocks quickly

|

Screening feature |

Quicken.com Full Screen |

Morningstar Stock Screener |

Yahoo! Finance Stock Screener |

|---|---|---|---|

|

Industry | |||

|

Market capitalization | |||

|

Investment style | |||

|

Growth rates |

One-, three-, and five-years revenue, EPS, and income |

One-, three-, and five- years revenue, and five-years EPS | |

|

P/E ratio | |||

|

PEG ratio | |||

|

Dividend yield | |||

|

Debt ratio | |||

|

Profit margin | |||

|

ROE and ROA |

ROE only | ||

|

Percent institutional ownership | |||

|

Test choices |

Optional minimum and maximum values |

Greater than or equal to |

Small menu of choices |

- Quicken.com (http://www.quicken.com/investments/stocks/search/)

Quicken.com screening tools take the prize in the fast and free category. Popular Searches use predefined criteria to find frequently sought-after stocks, such as small-cap growth stocks or high-yield stocks. If you like handholding, the EasyStep Search feature walks you through the construction of a stock screen one step at a time. Each step includes an explanation of how you might use that criterion. Clicking the criterion label opens a window with a glossary definition for the measure. The Full Search screener offers 41 screening variables. On the results page, click Compare Stocks to display company financial measure side by side in a table or graphed in a chart [Hack #34] .

- Morningstar Stock Screener (http://screen.morningstar.com/StockSelector.html?ssection=StockScreener)

Morningstar offers a simple, customizable screening tool as well as several built-in screens with catchy names and attractive philosophies, such as Profitable but Unloved, Blue-Blood Blue Chips, and Classic Appeal. The customizable tool offers 17 variables with numerous values on drop-down lists. Whether you use built-in screens or create your own, you can choose different views of company data, including Snapshot for variables such as the stock sector and market cap, or Company Performance for growth rates, ROE, and debt ratio. To sort the results by a financial measure, simply click the column heading. When you use a built-in screen, you can select the Set Criteria tab to create a customized screen based on the criteria for the built-in screen.

- Yahoo! Finance Stock Screener (http://screener.finance.yahoo.com/newscreener.html)

The Yahoo! Finance Stock Screener comes in two varieties: the HTML version and the Java version. Click the Launch HTML Screener link to access a rudimentary and easy-to-use screening tool that offers 17 variables. Drop-down lists for each variable make it easy to specify criteria, but the screens you can create with this tool are elementary. On the Stock Screener page, click the Large Cap Value link or Bargain Growth link to open the stock screener with the preset screen in place, or click the More Preset Screens link to access the remaining 19 built-in screens such as Strong Forecasted Growth, which screens for companies estimated to earn at least 30 percent a year for the next five years. The built-in screens run the Java version of the stock screening tool [Hack #5] and open a window showing the screen criteria and results. You can modify the criteria to customize the screen and sort the results by clicking column headers.

Tip

The basic online stock screening tool offered by MSN Money is far too simplistic to be of any value. However, MSN Money provides dozens of built-in stock screens (http://money.msn.com/investor/finder/predefstocks.aspx), including some of the only free technical screens available online. In addition, you can download a plug-in to use their powerful customized screening tool [Hack #5] .

Let’s use the Quicken.com Full Search tool to find some large-cap growth companies that also pay attractive dividends. The stock prices for companies like this are less volatile and hold up in down markets. However, with growth companies that pay dividends, they allow you to receive total return from both price appreciation and dividend yield.

Navigate to http://www.quicken.com/investments/stocks/search/full/ to open the web page for the Full Search screening tool.

To specify that you want large-cap companies, choose at least $5B on the Market Cap drop-down list. You can also type a value such as

25,000in the Market Cap Min box, for example if you want companies with market capitalization of at least $25 billion.To look for companies that offer a dividend yield [Hack #27] of at least 3 percent, type

3in the Min box for Dividend Yield. To ensure that companies keep enough earnings to fund future growth, limit the dividend yield by typing a value such as7in the Max box.To find companies that are growing at an above-average rate for their size, type

10in the Min box for 5 yr. EPS Growth. The 5 yr. EPS Growth drop-down list includes options, such as “Above industry average” and “At least 15%.” To look for companies expected to continue growing in the future, you can specify a minimum growth rate in the Earnings Growth Avg Est Next 5 Yrs criterion.To search for companies that don’t carry excessive debt [Hack #29] , which can burden companies when times are bad, limit the debt-to-equity ratio to 30 percent by typing

30in the Max box for LTD/Equity Ratio.To ensure that the companies provide an adequate return on shareholders’ investment in the company [Hack #30] , type

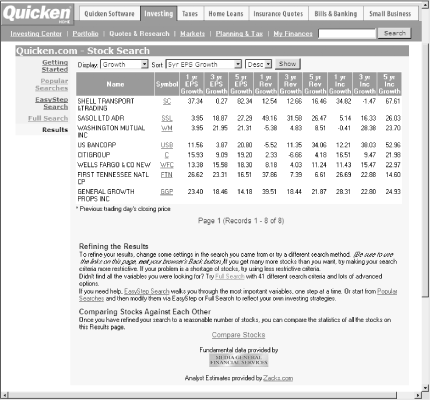

15in the Min box for Return on Equity.To display the results, choose the type of data you want to see from the “Select which data to display” drop-down list. For example, choose Growth to display EPS, Sales, and Income growth rates for the past one, three, and five years. Click Show Results to view the companies that meet your criteria, as shown in Figure 1-4.

Figure 1-4. Sort the Quicken.com Full Search results, or change the criteria to tighten or loosen the search criteria

To sort the results, select the field to sort by in the Sort drop-down list. Select Asc or Desc to sort the companies in ascending or descending order, respectively.

To modify the search criteria, for example to further reduce the number of results, click the Full Search link in the left margin. Make the changes you want to the screen and click Show Results again.

Tip

If your screens return too many companies, you can change several criteria before resubmitting your screen. However, when the number of stocks is close to what you want, tighten up the criterion that is most important to you, such as the dividend yield if you want current income or EPS growth if you want price appreciation.

Get Online Investing Hacks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.