2.19 EXEMPTIONS FROM OTHER IFRSS

2.19.1 Share-Based Payment Transactions

2.19.1.1 Exemption Explained

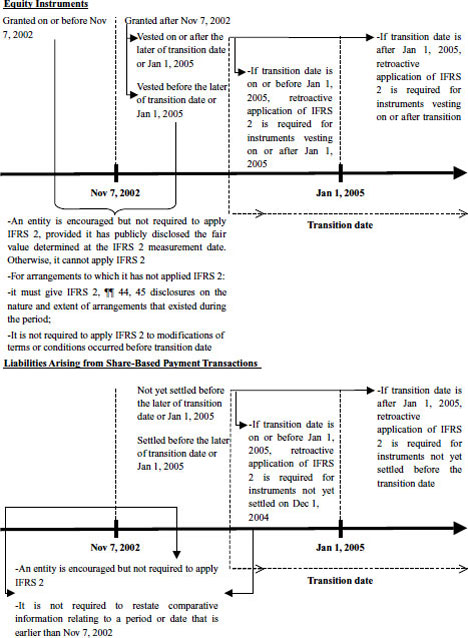

IFRS 1 permits some relief from IFRS 2 based on date of grant and date of vesting of share-based instruments.582 Exhibit 2-23 illustrates this exemption.

Exhibit 2-23 Share-Based Payment Transaction Exemption under IFRS 1

A European survey indicates that all 2005 first-time adopters used this exemption, when available.584 A 2005 survey of 45 IFRS first-time adopters illustrates that approximately 58% used this exemption.585 A survey of interim reports of 144 listed companies in FTSE 101-350 in 2005 converting from UK GAAP to IFRSs reveals that 76% availed themselves of this exemption.586

2.19.1.2 Implications for Accounting Estimates

Paragraph 2.11.14 previously explains the implications on ...

Get The Handbook to IFRS Transition and to IFRS U.S. GAAP Dual Reporting now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.