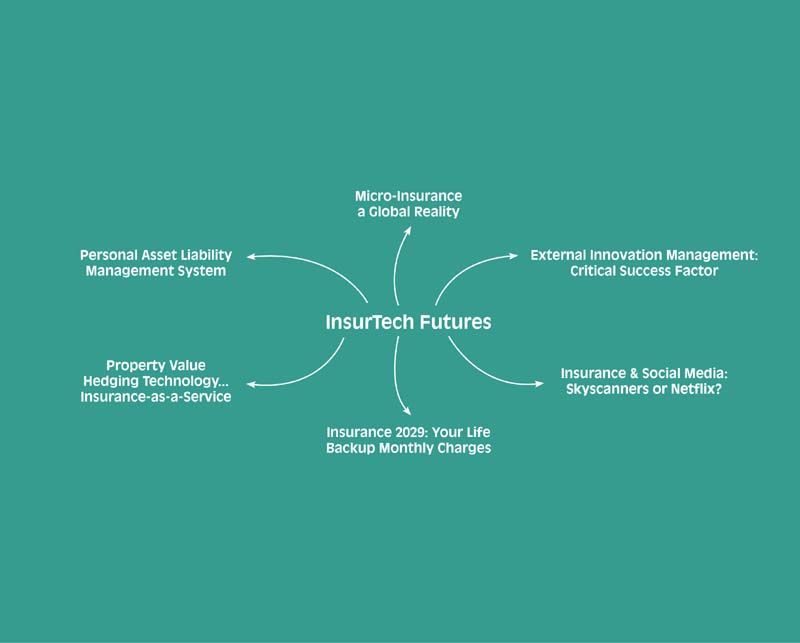

9InsurTech Futures

Our contributors for this part took on the brief of imagining the InsurTech futurescape with real gusto. Six writers from around the world present their interpretations and visions of what’s in store, and, for us, the variety of perspectives here is almost as fascinating as the chapters themselves.

For Ulrich Kleipass, it is obvious that innovation in insurance is far from new – but what is new is how the sector is no longer totally inward looking, but actively externally focused (on partners, customers, and even peers) to get innovation and digitalization done. This makes getting “external innovation management” right absolutely critical, and Kleipass offers up a practical eight-point action plan for insurer incumbents to do just that.

Pauline Davies’ powerful arguments for the new world of “connected customer” to actually mean the acceleration of microinsurance hit home. Davies’ detailed analysis of the current state of non-insurance, especially in Africa, and examination of how digitalization and InsurTech can change this situation is down-to-earth yet inspiring. Many will feel that enabling microinsurance is, of itself, a rationale for InsurTech worth rallying around.

The third piece in this part comes from Ming Chiu and Yawei Cui. They analyse the future of InsurTech as a means of both “demand-side”, i.e. customer, understanding and control, and “supply-side” ...

Get The INSURTECH Book now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.