SABR Model

The SABR model [4] is a stochastic volatility (see Stochastic Volatility Models) model in which the forward asset price follows the dynamics in a forward measure ![]() :

:

![]()

![]()

![]()

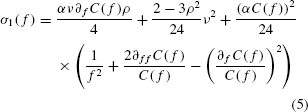

The stochastic volatility at, is described by a geometric Brownian motion. The model depends on four parameters: α, ν, ρ, and β. By using singular perturbation techniques, Hagan et al. [4] obtained a closed-form formula for the implied volatility σBS(![]() , K), at the first-order in the maturity

, K), at the first-order in the maturity ![]() . Here, we display a corrected version of the formula [8]:

. Here, we display a corrected version of the formula [8]:

![]()

with

Though this formula is popular, volatility does not mean-revert ...

Get Encyclopedia of Quantitative Finance, IV Volume Set now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.