Higher Current Returns

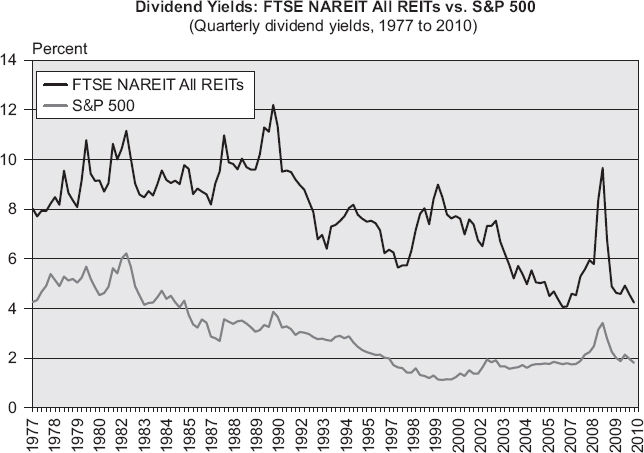

As we'll see in Chapter 3, REITs must, by law, pay out at least 90 percent of their pretax income to shareholders in the form of dividends. As a result, REITs' dividends tend to be higher than those of other companies as a percentage of their free cash flows, and REIT shares normally trade at higher dividend yields (see Figure 1.3).

Figure 1.3 REIT Yield Comparison vs. S&500

Source: NAREIT REITwatch, January 2011.

Although many academics claim that it shouldn't matter to shareholders how much of its net income a corporation pays out in dividends, many argue that dividends really do matter with respect to shareholders' total ...

Get Investing in REITs: Real Estate Investment Trusts, 4th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.