CHAPTER 6 Candlesticks and Gaps

This section deals with candlestick patterns and gaps. Candlesticks display the same information as OHLC bars, but form a box between the open and the close, making it easier to see if there's been an up or down close, and to see patterns formed by one to three bars. Gaps, as the name implies, are price ranges over which no trading took place between one bar and the next. The placement of gaps before or after key patterns, or during trends, can give clues as to the market's future action.

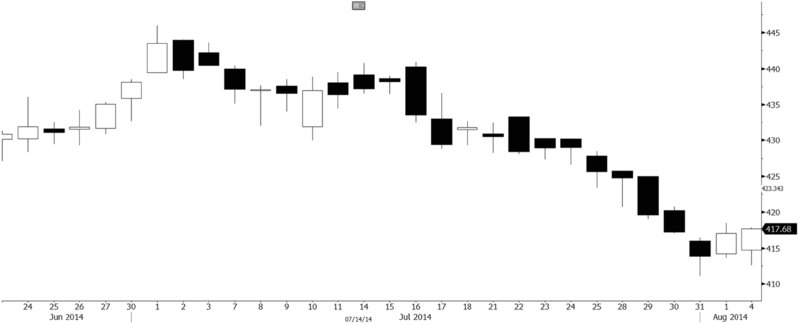

QUESTION 6.1 Y Candlestick Chart with Gaps

- What is the candlestick pattern at the top of the market?

- Find and identify two gaps, and describe their meaning.

- Can you find a bearish engulfing line within the down trend? Circle it.

- Can you find a failed (unconfirmed) Harami line and star? Circle it.

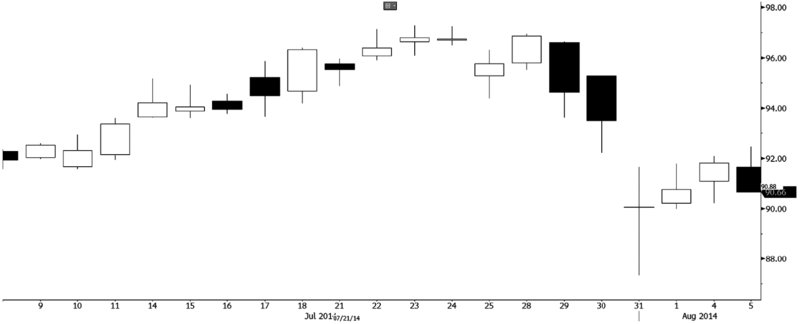

QUESTION 6.2 CI Candlestick Chart with Gaps

- Identify at least one failed bearish candlestick pattern.

- Identify and label at least two gaps.

- What's the pattern at the bottom of the market to the right?

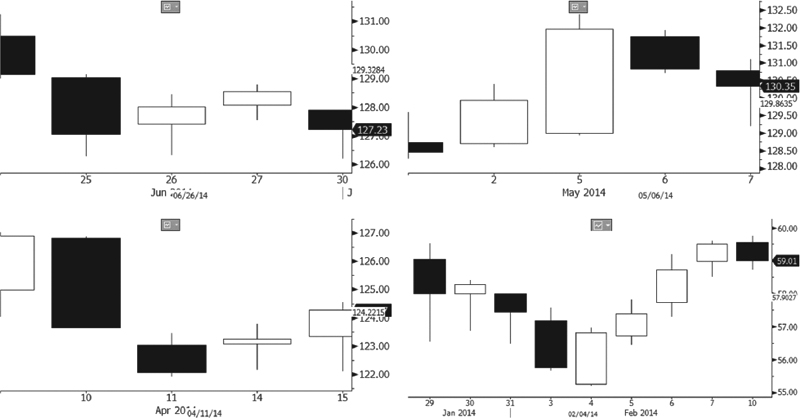

QUESTION 6.3 BA with Candlestick Patterns

- Draw in the completion and confirmation points for the charts above.

- Name the candlesticks or candlestick setups. ...

Get Kase on Technical Analysis Workbook, + Video Course now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.