| Chapter 8 | Accounting for Receivables |

Learning Objectives

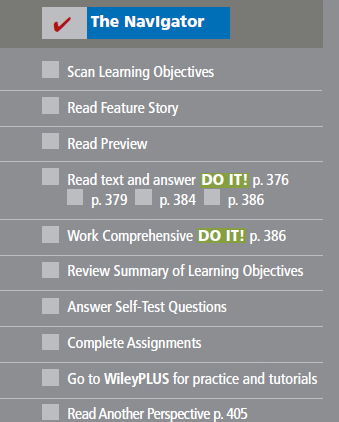

After studying this chapter, you should be able to:

1 Identify the different types of receivables.

2 Explain how companies recognize accounts receivable.

3 Distinguish between the methods and bases companies use to value accounts receivable.

4 Describe the entries to record the disposition of accounts receivable.

5 Compute the maturity date of and interest on notes receivable.

6 Explain how companies recognize notes receivable.

7 Describe how companies value notes receivable.

8 Describe the entries to record the disposition of notes receivable.

9 Explain the statement presentation and analysis of receivables.

![]()

Feature Story

Are You Going to Pay Me—or Not?

What is the only thing harder than making a sale? Answer: Collecting the cash. Just ask a banker, virtually any banker. Bankers around the world have been awash in “doubtful” loans for years. And, it may be many years before the mess is finally cleaned up.

If your business sells most of its goods on credit or is in the business of making loans, then accurately recording your receivables is one of your most important accounting tasks. At the end of every accounting period, ...

Get Financial Accounting, IFRS Edition: 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.