| Chapter 13 | Statement of Cash Flows |

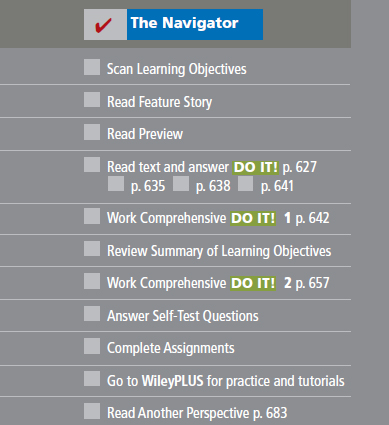

Learning Objectives

After studying this chapter, you should be able to:

1 Indicate the usefulness of the statement of cash flows.

2 Distinguish among operating, investing, and financing activities.

3 Prepare a statement of cash flows using the indirect method.

4 Analyze the statement of cash flows.

![]()

Feature Story

What Should We Do with This Cash?

In today's environment, companies must be ready to respond to changes quickly in order to survive and thrive. This requires that they manage their cash very carefully. A company's cash needs, and how it addresses them, depend on a lot of factors. For example, many high-tech companies need significant cash in order to grow, especially in their early years. To conserve cash, some young companies pay their employees with company shares, or share options. Not only does this conserve cash, but it creates an incentive for employees to work hard. If the company succeeds, then the value of their company shares will increase.

Successful mature companies frequently generate lots of cash—often exceeding their immediate needs. This excess cash is often referred to as “free cash flow.” A company with lots of free cash ...

Get Financial Accounting, IFRS Edition: 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.