Chapter 9

Short Selling and Stock Loans

Selling securities one does not own for future delivery (short selling) in the hope that the securities sold will decline in price and be acquired cheaper than the original sale price has been around at least as long as modern markets.1 Stock lending as a means to facilitate settlement or cover short sales does not have such a long history. In fact, it was the development of the listed options market in the United States in the 1970s that increased demand for securities to facilitate settlement in the 1960s, and the growth of the prime brokerage business in the 1980s that led to the growth of securities lending.

Now, securities lending, done pursuant to standardized agreements, is a principal means of finance (through repurchase transactions)2 and the principal vehicle to facilitate short selling and settlement.3

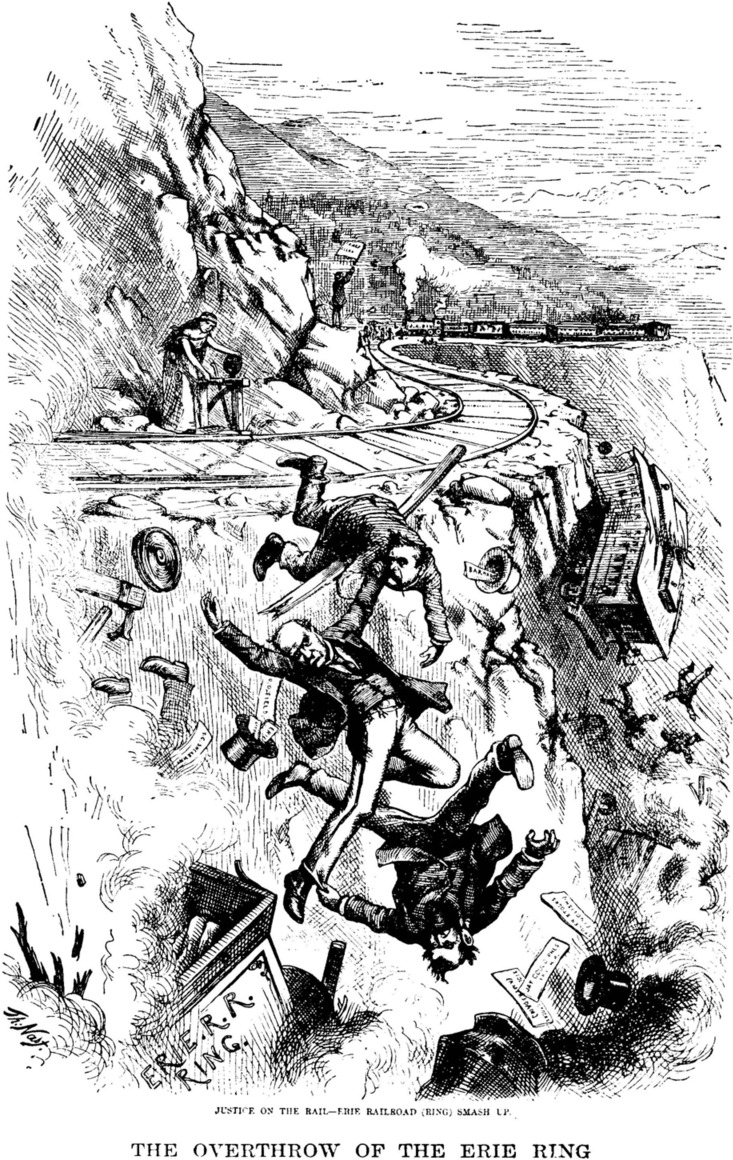

Source: Courtesy of Cartoonstock, Ltd. Reproduced with permission.

The downfall of Daniel Drew and his confederates, having been caught short.

In the United States, the Federal Reserve's Regulation T establishes the permitted purposes for which a broker-dealer may borrow securities. One such purpose allows brokers to borrow securities to complete deliveries. The broker-dealer can call other brokers or lending banks (which act as agents) to locate the needed securities. If the broker-dealer borrows the securities from another broker, ...