Solution to Stage Two

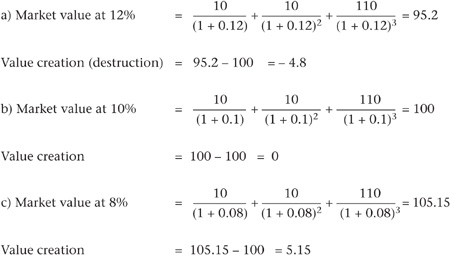

| 1: | Consider a bank with an initial equity of 100, an ROE of 10%, and a life of three years. The profit is paid every year as a dividend plus a closing dividend of 110 at the end of three years. Compute the market value and value creation for the cases when the market discounts are at 12%, 10% and 8%.

Managerial lesson To create value, the ROE must exceed the market discount rate, the cost of equity. |

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.