Credit-linked notes (CLN)

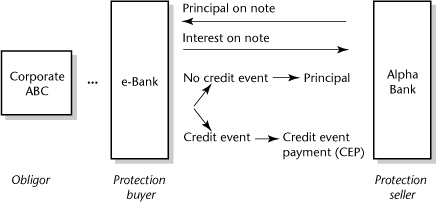

In the first two contracts, credit default swaps (CDS) and total rate of return swaps (TRORS), the protection buyer is exposed to the risk that its counterparty, the protection seller, does not meet its insurance obligations. Can we really mitigate that risk? Wonder of financial engineering, we can. Let us analyse credit-linked notes (CLN) (Figure 18.3).

Figure 18.3. The credit-linked notes (CLN)

In the first step, a protection buyer, e-Bank, borrows from Alpha Bank, in issuing a note (a bond). It receives the capital/principal on this issue. In the second step, e-Bank pays the interest on the note to Alpha Bank, ...

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.