Measuring interest rate risk

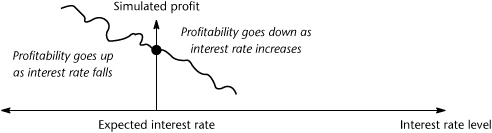

The impact of interest rate fluctuations on the profitability of e-Bank can be represented as shown in Figure 12.1.

Figure 12.1. The impact of interest rate fluctuations on profitability

The specialists in the bank provide an interest rate forecast (the expected interest rate) and the accounting department calculates the ‘pro forma’ profitability given that forecast. As a risk manager, you need to understand how the profit will be affected if the forecast is wrong. In Figure 12.1, profitability goes down when the interest rate increases, while profit goes up if the interest rate goes down. This is only an example, ...

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.