Call option

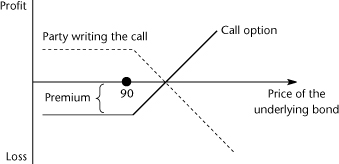

A call option is a right to buy a financial asset at a price fixed today (the exercise price or strike) with delivery at a future date (Figure 17.2).

Figure 17.2. A call option

On the right side of the exercise price of 90, the bond price goes up and the call option is exercised. On the left side of the graph, the bond price falls below 90 and the option is not exercised. In that case, the only loss will be the premium paid to buy the option.

An option is therefore a convenient tool to make a profit while keeping a limited downside risk.

Note that for the party selling (writing) the call, the payoff (dashed line) is completely ...

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.