Credit default swaps (CDS)

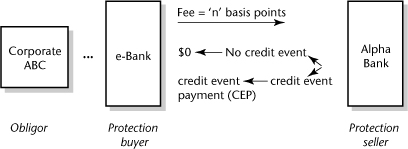

Here is the structure of the transaction between e-Bank and Alpha Bank. e-Bank, which has initial credit exposure to the corporate ABC, is called the protection buyer. Alpha Bank, willing to assume the credit risk, is called the protection seller. Corporate client ABC, which has borrowed from e-Bank, is called the obligor. The structure of the CDS is presented in Figure 18.1.

Figure 18.1. Credit default swaps (CDS)

In credit default swaps (CDS), the protection buyer, e-Bank, agrees to pay a credit insurance fee, ‘n’ basis points,[1] every quarter to the protection seller, Alpha Bank. If there is no default (no credit ...

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.