16

Our Valuation Framework

In this chapter we go through the conceptual logic behind our valuation model. (Readers who are familiar with the foundations of valuation theory, or those who are more interested in the practical applications, can skip to the next chapter.)

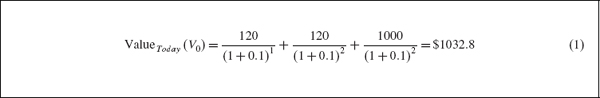

Intrinsic value is the discounted present value of cash we can take out of the company in the future. For anyone who has calculated the value of a simple bond, the calculation should sound very familiar. For those who have not, Figure 16.1 shows the calculation for a bond issued at a premium.

A bond has a two-year life. Its face value, to be paid at the end of the two years, is $1000. It has an annual coupon (cash payment) of 12% ($120), and the required rate of return (discount rate) is 10%.

Figure 16.1 The basis of all valuations – a fixed payments case

The intrinsic value of the bond is higher than the face (“book”) value because it generates and pays out a return in excess of the market's (investor's) required rate of return.

In this simple case, there is no uncertainty about the earnings and cash flows (assuming no bankruptcy risk), so the only ambiguity about the value could be in the discount rate. Consider the situation where all other investment opportunities of similar risk that are available to you offered an 8% return. You would view the value to be higher than $1033 (actually closer to $1070) and would ...

Get Equity Valuation: Models from Leading Investment Banks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.