38

Liquidation and Accounting Valuation

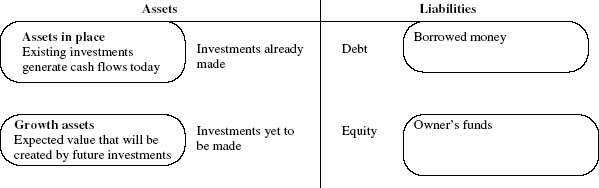

The value of an asset in the discounted cash flow framework is the present value of the expected cash flows on that asset. Extending this proposition to valuing a business, it can be argued that the value of a business is the sum of the values of the individual assets owned by the business. While this may be technically right, there is a key difference between valuing a collection of assets and a business. A business or a company is an ongoing entity with assets that it already owns and assets it expects to invest in the future. This can be best seen when we look at the financial balance sheet (as opposed to an accounting balance sheet) for an ongoing company in Figure 38.1:

Figure 38.1 A simple view of a firm

Note that investments that have already been made are categorized as assets in place, but investments that we expect the business to make in the future are growth assets.

A financial balance sheet provides a good framework to draw out the differences between valuing a business as a going concern and valuing it as a collection of assets. In a going concern valuation, we have to make our best judgments not only on existing investments but also on expected future investments and their profitability. While this may seem to be foolhardy, a large proportion of the market value of growth companies comes from their growth assets. In an asset-based ...

Get Equity Valuation: Models from Leading Investment Banks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.