SO ARE BONDS THE PLACE TO INVEST?

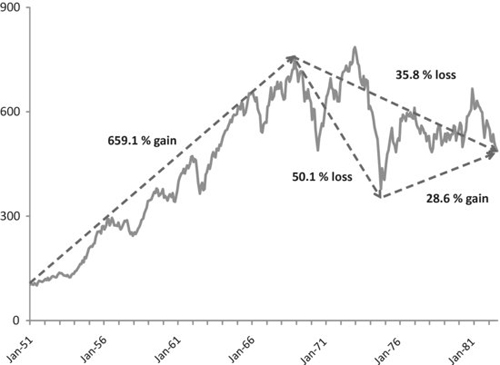

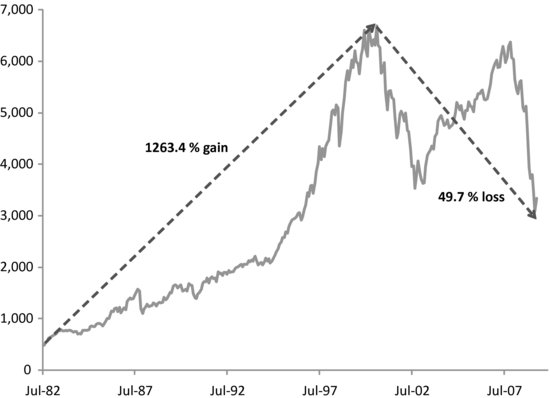

If bonds are such a savior in the current crisis, how good an investment have they been in the long run? Let’s focus on the long stock market cycles over the past 60 years that include booms and busts. We might identify four cycles: the post-war expansion, the inflation decade of the 1970s, the boom period of the 1980s and 1990s, and the bust period through March 2009. The timing of these four cycles is arbitrary, but some basis for the timing can be seen in Figures 1.1 and 1.2 where the real return on the S&P 500 is displayed. It’s important to examine long market cycles in real (inflation-adjusted) terms because it’s the real return that matters to the investor. (For the short periods surrounding economic downturns, it usually doesn’t matter whether real or nominal returns are examined). Besides, the inflation decade of the 1970s doesn’t look that bad in nominal terms. It’s only in real terms that we see the devastation caused by inflation during that decade.

Figure 1.1 suggests that the post-war expansion ended either in late 1968 or late 1972 (when returns were only marginally ...

Get Portfolio Design: A Modern Approach to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.