The risks of investment

Whenever you invest in property or shares, there is a risk involved. The risks are many and varied, and some are common to both of these asset classes. An outline of these risks is detailed later in this chapter.

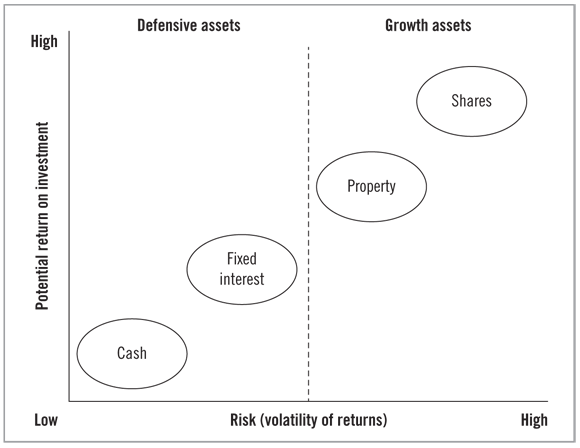

This risk–reward relationship is largely a result of a phenomenon called volatility. Volatility can be thought of as the potential range of returns you can expect to get (both positive and negative). Figure 7.1 shows the relevant risk and returns for each of the four main asset classes.

Figure 7.1: levels of risk and return for the four main asset classes

We can see that the trade-off for the opportunity to make high returns is taking on a proportional degree of risk. Most inexperienced investors fear volatility — but without volatility there isn’t much potential for return. The secret, therefore, is to manage your investment risk.

The amount of risk you take in investing will depend on the type of investment you make. For example, if you invest money in a defensive asset, such as a fixed term deposit in the bank, there is virtually no risk of you losing your money. When your fixed deposit matures, you will get your original investment back along with the interest payable on that investment. It’s important to be aware that the return you will ...