Chapter 26 Planning for Capital Investments

Learning Objectives

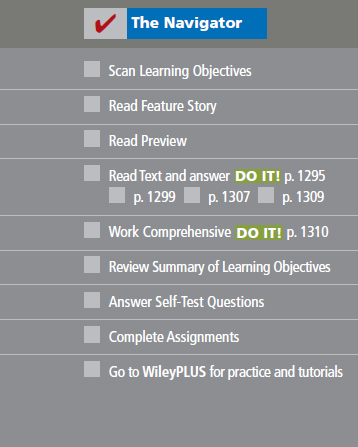

After studying this chapter, you should be able to:

- Discuss capital budgeting evaluation, and explain inputs used in capital budgeting.

- Describe the cash payback technique.

- Explain the net present value method.

- Identify the challenges presented by intangible benefits in capital budgeting.

- Describe the profitability index.

- Indicate the benefits of performing a post-audit.

- Explain the internal rate of return method.

- Describe the annual rate of return method.

![]()

Feature Story

Floating Hotels

Do you own a boat? Maybe it's a nice boat, but how many swimming pools, movie theaters, shopping malls, or restaurants does it have on board? If you are in the cruise-line business, like Holland America Line, you need all of these amenities and more just to stay afloat. Holland America Line is considered by many to be the leader of the premium luxury-liner segment.

Carnival Corporation, which owns Holland America Line and other cruise lines, is one of the largest vacation companies in the world. During one recent three-year period, Carnival spent more than $3 billion per year on capital expenditures. Those are big numbers, but keep ...

Get Financial and Managerial Accounting now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.