15.1. Naive Models

Naive forecasting models are based exclusively on historical observation of sales or other variables, such as earning and cash flows. They do not attempt to explain the underlying causal relationships that produce the variable being forecast.

Naive models may be classified into two groups. One group consists of simple projection models. These models require inputs of data from recent observation, but no statistical analysis is performed. The second group is made up of models that while naive, are complex enough to require a computer. Traditional methods such as classical decomposition, moving average, and exponential smoothing models are some examples.

The advantage is that it is inexpensive to develop, store data, and operate. The disadvantage is that it does not consider any possible causal relationships that underly the forecasted variable.

A simple example of a naive type:

Use the actual sales of the current period as the forecast for the next period. Let us the symbol Y't+1 as the forecast value and the symbol Yt as the actual value. Then

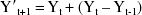

If you consider trends, then

This model adds the latest observed absolute period -to-period change to the most recent observed level of the variable.

If you want to incorporate the rate of change rather than the absolute ...

Get Budgeting Basics and Beyond now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.