87

5

Hazard Risk

In July 2011, a tsunami o the coast of Japan caused human tragedy on an

almost unimaginable scale, killing thousands and rendering almost a mil-

lion people homeless. Also in July, ooding in ailand forced the closure

of 9,800 factories and le more than 660,000 people unemployed. An

untold number of people around the globe were impacted by this natural

disaster, both personally and economically. In the automotive industry,

approximately 6,600 autos were not built per day. In the camera indus-

try, Nikon’s net loss of sales equaled $786 million, while Canon experi-

enced over $600 million in losses. With over 45% of all computer hard

drives produced in the aected area, many computer manufacturers had

to delay product launches, which resulted in lost sales and a doubling of

hard drive prices.

1

Unfortunately, examples of hazard risks are not hard

to come by.

Hazard risk pertains to random disruptions, some of which involve acts

of God. Additionally, hazard risk has traditionally involved liability torts,

property damage, and natural disasters. In this chapter, we will address how

corporations mitigate hazard risk, whether it’s a natural disaster, re, mali-

cious behavior, product tampering, the, or acts of terrorism. e chapter

will cover denitions, options, and variants of traditional and emerging

global disruption insurance products. Later chapters will present other tools

and approaches that support the eective management of hazard risk.

THE TRADITIONAL WORLD OF HAZARD RISK

AND INSURANCE

With global supply chains expanding to support growth initiatives,

many companies are entering into indemnity and other types of partner

88 • Supply Chain Risk Management: An Emerging Discipline

agreements in an eort to mitigate risk through risk pooling, sharing risk,

and disruption insurance. Insurance may not be the total solution to miti-

gating risk within this category, but many new and improved business and

trade disruption insurance products and services are emerging every day.

Before we move into denitions, options, and variants of risk transfer

packages, we’ll begin with a glimpse into the landscape of this traditional

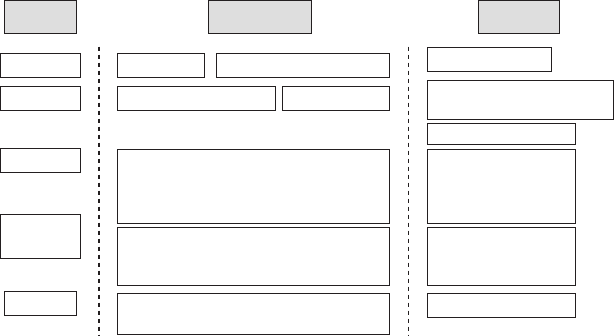

risk mitigation arena. We’ll use Figure5.1 as a reference point for our

entire chapter discussion. is gure includes three columns. From le to

right are the risks, the types of coverage, and nally the triggers or drivers

behind traditional hazard event mitigation insurance.

e rst risk in Figure5.1 is credit risk. e trigger event is normally

payment default, and the coverage is normally geared toward mitigating

for insolvency or protracted default by a partner or customer. Next are

political risks. e trigger events here are normally sovereign debt default

or asset loss and coverage that revolves around contract frustrations and

expropriation. Within the insurance coverage area for political risks,

contract frustration tends to revolve around corporate loans, the lenders’

interest, or project nancing of equity and debt. Also within this coverage

area, the bulk of expropriation revolves around xed investments (equity)

and possibly mobile assets, such as stocks.

Continuing down the le side of Figure5.1 is property risk. e trig-

gers in this category are physical damage or loss and additional perils

Risk

Credit Insolvency

Contract frustrations Expropriation

• Property replacement

• Lost profit

• Continuing & expediting expenses

• Contingent loss

Sovereign contractual

default

Asset loss

• Physical damage

• Certain perils

• Political

• Natural disasters

• Suppliers

• Loss/Damage

• Lost profit

• Continuing & expediting expenses

• Contingent loss

• Goods in transit

• Customs delays

Protracted default

Payment default

Political

Property

Trade

Disruption

Logistics

Coverage Trigger

FIGURE 5.1

Risk transfer tools—the business of hazard insurance. (Source: Eric Wieczorek, for-

mer risk director- navigant, “Supply Chain Risk Management” presentation at MAPI,

Manufacturing Alliance for Productivity & Innovation’s Council Meeting, 2013.)

Get Supply Chain Risk Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.