CHAPTER 8

Dividends and Buybacks: Calibrating Your Shareholder Distributions

In the face of recent events, dividend and share repurchase policies are being rewritten. Dividend and buyback announcements are increasing as companies struggle to deal with languishing share prices and uncertain futures. Low interest rates, weak share prices, uncertain markets, and large and growing cash balances are putting pressure on companies to increase shareholder distributions (dividends and buybacks).

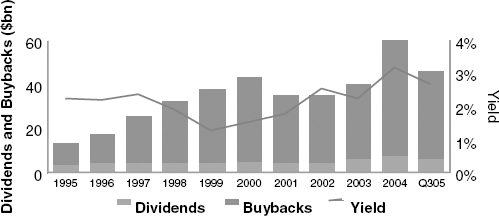

Shareholder distributions are under intense scrutiny. The first announcement by Microsoft to initiate a small dividend (and its subsequent announcements to double and double again its dividend to distribute $75 billion over three years in dividends and buybacks) contrasted with an announcement the prior year to reinvest $10 billion in additional research. Dividends and share repurchases have reached significant levels in Technology, despite the sector’s tremendous growth prospects (Figure 8.1).

FIGURE 8.1 Technology Sector Dividends and Buybacks

During 2005, most companies of the S&P 500 index repurchased their own shares and paid. Over the past 10 years, shareholder distributions have changed significantly.

- U.S. buyback volume more than tripled as a percentage of the market value of equity.

- Dividends have declined over the same period. Yields and payout ratios fell by about 25 percent.

- Share ...