MULTIVARIATE CREDIT MODELS

Credit analysts have long relied on multiple ratios for their quantitative analysis, frequently leading to questions around the relative importance of each. Regression analysis can be employed to determine an optimal basket of metrics for a given sample of historical data and assign relative weightings to each ratio. A multivariate model is effectively a weighted average approach to multiple ratios.

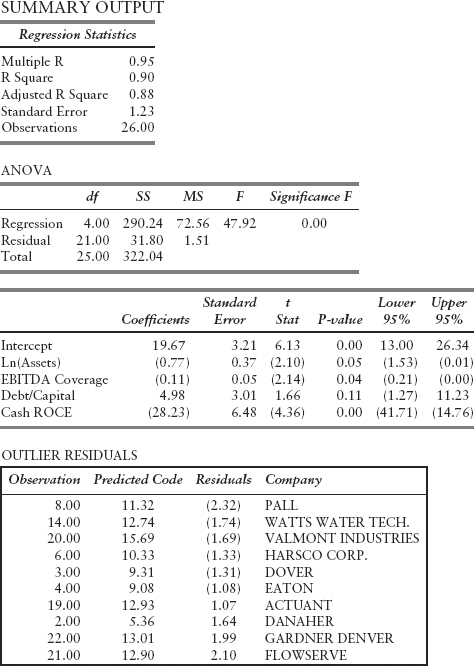

For example, continuing with the data from our machinery manufacturing example, we develop a model that is a weighted score of size, financial leverage and interest coverage ratios (Figure 6.3). This model explains a full 90 percent of the variation in all long-term ratings across the sector (26 rated companies with LTM cross sectional data); however, the standard error shows that predicted ratings can be of by a full notch.6 The model works best in the middle zone of the rating range (A through B) but maintains reasonable predictive power to the extreme scores. In practice, we tailor industry-specific models with a narrow dataset and high explanatory power. Standard error can be problematic, and all scores often fall within two notches at 95 percent confidence. When we sorted the residuals to understand the model error better, we could qualitatively reconcile the bulk of the error.

FIGURE 6.3 Regression-Based Credit Model

The model predicts Flowserve as ...

Get Strategic Corporate Finance: Applications in Valuation and Capital Structure now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.