CASE STUDY: ILLUSTRATION OF SECURED AND UNSECURED NOTCHING

Figure 6.4 illustrates a framework for notching up secured debt and notching down unsecured debt. In practice, conventions may vary. Rating agencies have differing notching criteria for investment-grade and high-yield issuers. Typically, investment-grade issuer notching of subordinated debt is limited to one notch below the issuer level, whereas it is generally two notches lower for high-yield issuers. Because investment-grade issuers typically do not have secured debt in their capital structures, their senior unsecured debt is usually rated at the issuer level.

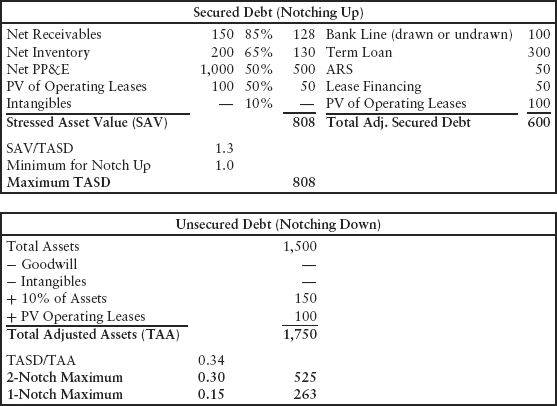

FIGURE 6.4 Illustration of Notching Up and Notching Down

In this illustration, the issuer has secured debt of $600 million (drawn and undrawn secured lines, revolver, term loan, securitizations and leases), less than the $808 million threshold for a one-notch upgrade (from the issuer level) on secured debt. However, secured debt is higher than the two-notch threshold for notching down lower-priority ranking debt (investment grade has one threshold at 20 percent); therefore, the unsecured debt is notched down two notches. Reducing secured debt from $600 million to $525 million would improve this to only a one-notch downgrade on lower priority debt. Reducing it below $263 million would remove any notching down on the unsecured debt.

1. Koresh Gagil in “The Quality ...

Get Strategic Corporate Finance: Applications in Valuation and Capital Structure now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.