BALANCING PERFORMANCE WITH VALUE

Intrinsic value is not maximized solely through the maximization of current operations value but through the simultaneous maximization of COV and growth value.

This requires the renewal of growth value through investments in intangibles and the future and requires the conversion of opportunities into performance, via execution or operational excellence. The implications for business strategy, financial policy, and compensation are far-reaching.

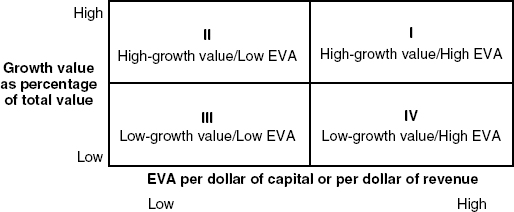

Figure 2.5 illustrates a portfolio tool that maps businesses (companies, products, SKUs, customers) performance (economic margin) on the horizontal axis and valuation (growth value as a percentage of enterprise value) vertically.

FIGURE 2.5 Performance/Value Matrix

Quadrant I illustrates cases where products enjoy a premium position but may have been neglected due to smaller size, traditional income-based margins, and other reasons. However, they may use little capital, creating a superior economic profit margin. They may also be highly scalable due to a global brand and ease of contract manufacture, making them an attractive story.

Quadrant II is where we find the hot businesses with high expectations for upside, or poor performers that would be worth far less except for their minimum valuation floor, often due to the threat of a takeover or breakup. Some, with negative EP contribution may be legacy brands ...

Get Strategic Corporate Finance: Applications in Valuation and Capital Structure now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.