M&A TODAY

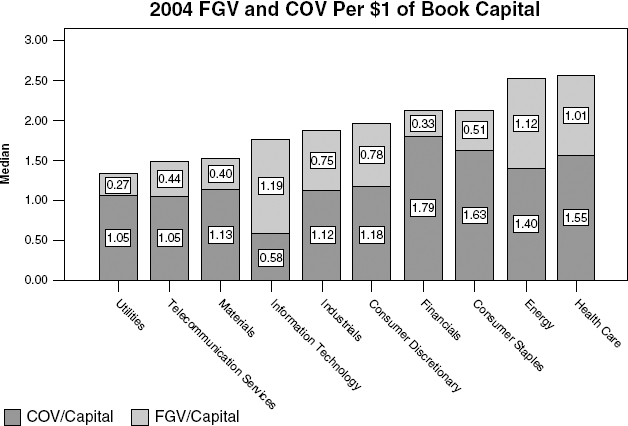

Several factors in today’s business environment contribute to an M&A climate that is more attractive today than it has been in several years. Resurgent interest in M&A, combined with the dubious track record and the prevalence of big wins and losses, makes this an important area of study for corporate finance practitioners and academics alike. Market valuations reveal a chronic dependence on expectations for positive net present value (NPV) growth (see Figure 4.1).

FIGURE 4.1 2004 GV and COV per $1 of Book Capital

“Quiet Period”

Bold strategic action had been on hold as executives and their directors sorted through a wave of inward facing initiatives, such as accounting (e.g., restatements, stock options, FAS 133), governance, and regulatory (e.g., SOX) reform. A long run of bankruptcies and corporate scandals, continued threat of terror, conflict in the Middle East, rocketing oil and steel prices, and election year politics, contributed to an overwhelming reticence toward action and slowed the stock market recovery.

An overhang on stock market valuations made sellers reluctant to sell and deterred buyers as they saw their own currency similarly devalued. The subsequent decline of “mega deals” ($10 billion+) was a principal dampener on M&A activity after the 1998–2000 peak, though we see stabilization now underway. The “quiet period” has ended; pent-up demand is sizable, ...

Get Strategic Corporate Finance: Applications in Valuation and Capital Structure now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.