DIVESTITURE CREATES VALUE

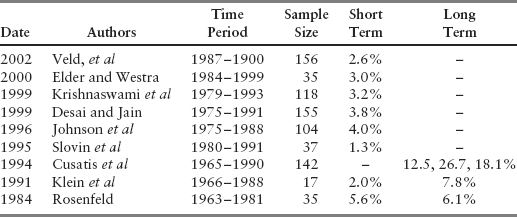

Studies of the value created by restructuring have found that parents’ short-term cumulative abnormal returns average in the 2 to 4 percent range around the time of the announcement (Table 3.1). Divested subsidiaries outperform their industry indices by about 6 percent in their first year. The most common approach to evaluating value creation from public divestiture transactions is to assess the excess returns around the time of the announcement because markets capitalize the benefits into prices within a few days around announcement. Much of the benefit is captured in the week prior to public announcement.

TABLE 3.1 Summary of Academic Findings

Longer-term value creation of divested business is material and significant. Longer-term operating improvements have been demonstrated, supporting explanations of increased managerial efficiency and focus due to better incentives and resource allocation. Long-run estimates of value creation are more contentious, but some range as high as 20 to 25 percent. We do not focus on the longer-term impact to the parents because the rationales reflect benefits primarily to the subsidiary businesses and because the scale of the parent and other external factors will be more significant.

Analysis of the past decade will show that spin-offs created the most value, followed by carve-outs; parent companies that chose to divest ...

Get Strategic Corporate Finance: Applications in Valuation and Capital Structure now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.