5.3 INDUSTRY-LEVEL SENTIMENT

In the previous section, I demonstrated how to construct a market-level news sentiment index that can be used to predict the future direction of the S&P 500. Here, I will focus on constructing market-neutral strategies taking long and short positions in the top- and bottom-ranked industries, respectively. Being able to successfully rank industries based on sentiment should enhance the performance of a strategy, since more targeted investments can be made towards expected outperformers and underperformers during periods with long and short exposures, respectively.

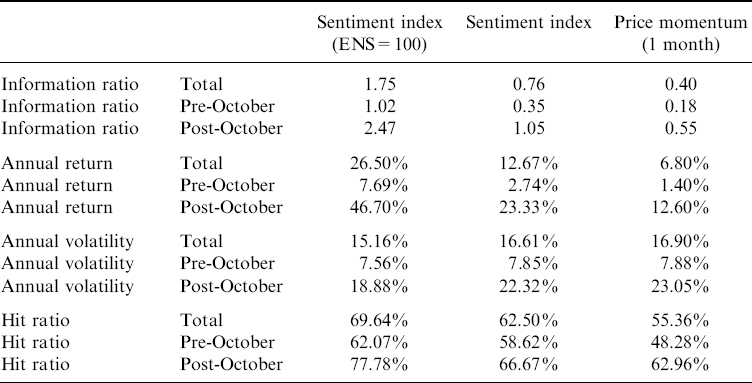

Table 5.1. Performance statistics covering the out-of-sample period May 2005 through December 2009 for the strategies based on the Market-Level Sentiment Index (column 3) with an Event Novelty Score filter (ENS = 100), the Market-Level Sentiment Index (column 4) without an Event Novelty Score filter, and the 1-month price momentum strategy based on the S&P 500 (column 5). Pre-October and Post-October refer to the market high in October 2007

Table 5.2. Yearly annualized return covering the out-of-sample period May 2005 through December 2009 for strategies based on the Market-Level Sentiment Index (column 2) with an Event Novelty Score filter (ENS=100), the Market-Level Sentiment Index (column 3) without an Event Novelty Score filter, and the 1-month price momentum strategy based on the S&P 500 ...

Get The Handbook of News Analytics in Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.