THE TRADE LIFE CYCLE FOR INTEREST RATE FLOORS

- Recording the trade—contingent

- Account for the premium on the trade

- Receive or pay the premium for the trade

- Reset the interest rate for the ensuing period

- Account for accrued interest if any on the valuation date

- Reverse the accrued interest if any on the coupon date

- Ascertain and account for the fair value on the valuation date

- Pay or receive interest on the pay date

- Termination of the trade and accounting for the termination fee

- Payment or receipt of the termination fee

- Maturity of the trade

- Reversal of the contingent entry on maturity/termination

- FX revaluation entries (for foreign currency trades)

- FX translation entries (for foreign currency trades)

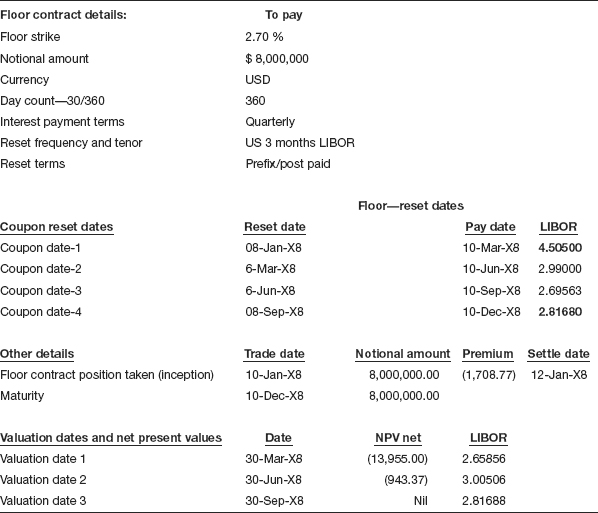

To understand the trade life cycle events and the associated journal entries to be recorded on the respective dates, let us look at the illustration as shown in Table 10.2:

Table 10.2 Details of interest rate floor instrument

Get Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.