PAY FIXED AND RECEIVE FLOATING—ILLUSTRATION 1

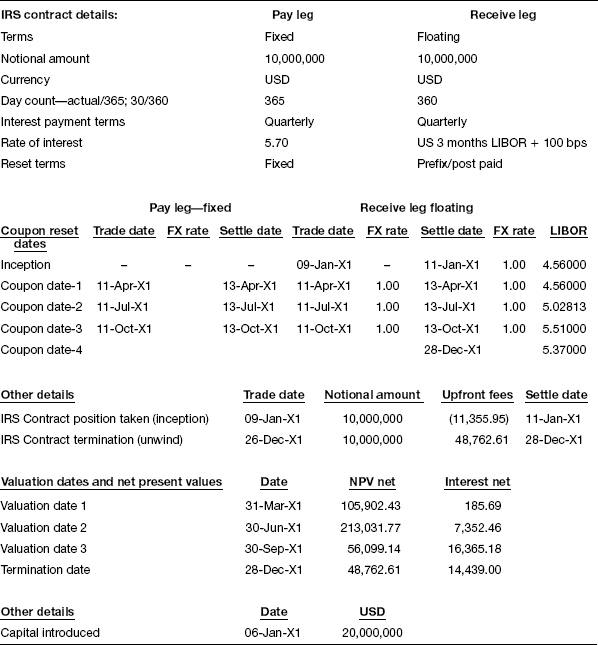

The details of the interest rate swap contract for Illustration 1 are given in Table 8.2.

Table 8.2 Details of IRS contract

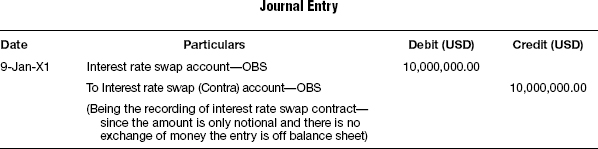

Recording the trade—contingent (at the inception of the interest rate swap)

Unlike bonds and equities, in an interest rate swap generally there is no exchange of money taking place of principal during the purchase and at expiry of the swap. The interest rates to be paid are calculated on a notional amount.

In the current example, where the interest rate swap agreement is based on fixed-for-floating, a series of payments calculated by applying a fixed rate of interest to a notional principal amount is exchanged for a stream of payments similarly calculated but using a floating rate of interest.

As this is a notional amount and no physical exchange of money takes place, an off balance sheet entry is recorded. The accounting entry that is recorded in the books of accounts is as shown in Table 8.3.

Table 8.3 On purchase of interest rate swap trade

Account for upfront fee on purchase of interest rate swap trade

The net present value of a time series of cash flows, both incoming and outgoing, is calculated by arriving at the sum of the present values of the individual cash flows. The net present value of the interest rate ...

Get Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.