CORPORATE ACTION

A corporate action is, as the name implies, an action taken by the issuer of the bonds that impact the investments or earnings from such investments. Typical examples of corporate actions include interest payment by the company, calls or the issuance of new debt by the issuer that result in change of the name or number of bonds held by the investor, and so on.

Coupon accrual

One of the key activities during the trade life cycle of fixed income securities is the corporate action in the form of interest as stated on the face of the bond. The accounting event for coupon accrual is recorded on the date on which the interest becomes payable by the company. The actual receipt of the interest itself may be based on the terms of the payment, which is usually based on any of the accepted payment conventions in vogue. Usually the bond interest is payable on a semi-annual basis. Except for the first interest that is received by the investor after acquiring the bonds, the amount for which the coupon entry is recorded every six months will be more or less the same. Interest will differ based on the day count convention used.

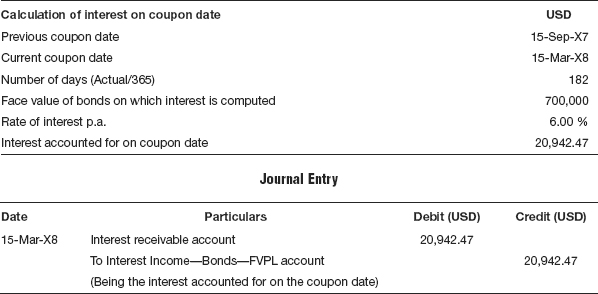

The accounting entry that is recorded in the books of accounts is shown in Table 2.6.

Table 2.6 On accounting for interest on the coupon date

Reversal of accrued interest purchased

The accrued interest purchased on the date of purchase of the bond is reversed ...

Get Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.