Other Risk

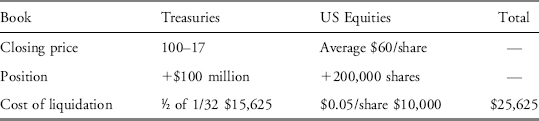

Liquidity risk is another big risk within a bank which was highlighted as a major issue in the 2008–2009 credit crisis. Liquidity in this context is about how much trades each day in a particular product (the daily volume) and how volatile the prices in that market are (which can be estimated from how wide the bid–offer spread is). This drives the cost of closing out or unwinding positions in a trading book. The issue being, if the bank decided to cut all its risk positions to zero, what the cost to get out would be (Table 13.6).

TABLE 13.6 Sample Liquidation Cost

In the 2008–2009 credit crisis, liquidity dried up in certain products ...

Get How the Trading Floor Really Works now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.