ARCHITECTURAL BUILDING BLOCKS

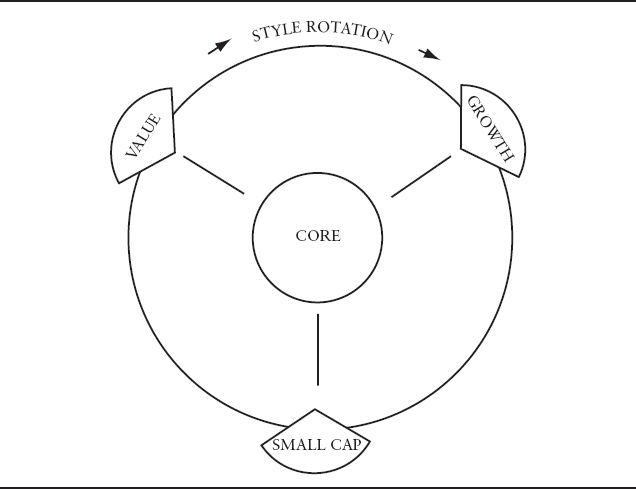

Exhibit 6.1 provides a simple but fairly comprehensive view of the equity market.1 The heart of the structure, the core, represents the overall market. Theoretically, this would include all equity issues for the United States and other markets. In line with the practice of most equity managers, a broad-based equity index such as the S&P 500, or (even broader) the Russell 3000 or Wilshire 5000, may proxy for the aggregate U.S. market.

EXHIBIT 6.1 Equity Market Architectural Building Blocks

For both equity managers and their clients, the overall market represents a natural and intuitive starting place. It is the ultimate selection pool for all equity strategies. Furthermore, the long-term returns offered by the U.S. equity market have historically outperformed alternative asset classes in the majority of multiyear periods. The aim of most institutional investors (even those that do not hold core investments per se) is to capture, or outdo, this equity return premium.

The core equity market can be broken down into subsets that comprise stocks with similar price behaviors—large-cap growth, large-cap value, and small-cap stocks. In Exhibit 6.1, the wedges circling the core represent these style subsets. The aggregate of the stocks forming the subsets equals the overall core market.

One advantage of viewing the market as a collection of subsets is the ability ...

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.